Loading

Get Form 15ca - Webtel

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 15CA - Webtel online

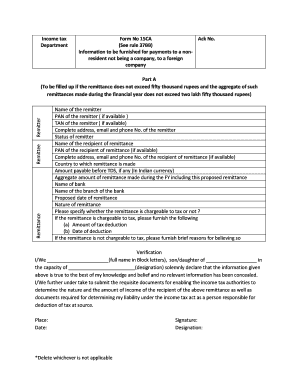

Filling out Form 15CA online is a crucial step for individuals and entities making remittances to non-residents. This guide will walk you through the components of the form, providing detailed instructions tailored to your needs.

Follow the steps to complete your Form 15CA online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin with Part A. Fill in your name as the remitter, along with your Permanent Account Number (PAN) and Tax Deduction Account Number (TAN) if available. Provide your complete address, email, and phone number. Select your status as remitter.

- Provide the name of the recipient of the remittance, their PAN (if available), and complete address details, including email and phone number. Specify the country where the remittance is made.

- Input the amount payable before Tax Deducted at Source (TDS) and the aggregate amount of remittances made during the financial year, including this proposed remittance.

- Fill in the bank details, including the name of the bank and branch, along with the proposed date of remittance.

- Indicate the nature of the remittance and specify whether it is chargeable to tax in India. If it is chargeable, provide the amount of tax deduction and the date of deduction.

- If the remittance is not chargeable to tax, briefly explain your reasons for this determination.

- Complete the verification section by providing your full name in block letters, your relationship to the remitter, and sign the form. Be sure to include the date and place.

- For Parts B and C, follow similar instructions as in Part A, entering the necessary details specific to the remittance type, the applicable codes, and required certifications.

- After completing all parts of the form, save your changes. You can then download, print, or share the form as needed.

Complete your Form 15CA online today to ensure compliance and a smooth remittance process.

Step 1 Login and navigate to the menu e-File Prepare and Submit Online Form (Other than ITR) Form 15CA . Step 2 Select the appropriate part (There are total 4 parts based on the remittances). Step 3 Fill the requisite data in the form and click on submit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.