Loading

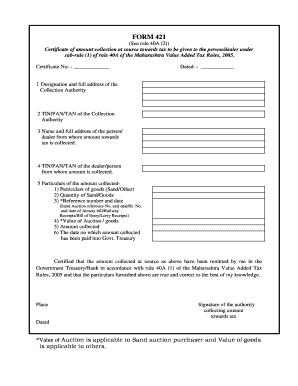

Get Form 421 (see Rule 40a (2)) Certificate Of Amount Collection At Source Towards Tax To Be Given To

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 421 (See Rule 40A (2)) Certificate Of Amount Collection At Source Towards Tax To Be Given To online

Filling out the FORM 421 is essential for documenting the collection of tax at source. This guide provides a step-by-step approach to completing the form accurately and efficiently in an online format.

Follow the steps to complete FORM 421 online.

- Click the ‘Get Form’ button to access the form and open it for editing.

- Enter the certificate number in the designated field. This unique identifier helps in tracking the document.

- Input the date of certificate issuance in the appropriate field, ensuring the format matches the required standard.

- Provide the designation and full address of the collection authority. This information identifies the entity responsible for collecting the tax.

- Fill in the TIN, PAN, or TAN of the collection authority to enable proper verification and record-keeping.

- Enter the name and full address of the person or dealer from whom the tax is collected. This establishes who the tax payment is attributed to.

- Input the TIN, PAN, or TAN of the dealer or person from whom the amount is collected for accurate identification.

- Detail the particulars of the amount collected, including the following fields: 1) Type of goods (Sand/Other), 2) Quantity of goods, and 3) Reference number and date (appropriate to the type of goods).

- Enter the value of the auction or goods as applicable. Be sure to specify the context (auction for Sand or other goods).

- Document the total amount collected based on the entries made above.

- State the date on which the collected amount has been paid into the Government Treasury for auditing purposes.

- Review all entries for accuracy and completeness before proceeding to certify the information provided.

- In the space provided, include the place of signing and ensure that the authority collecting the amount signs and dates the document to confirm correctness.

- Once completed, you can save your changes, download the form, print it, or share it as needed for your records.

Take action now and complete your FORM 421 online to ensure timely submission.

Every e-commerce company has to collect some tax on the net transaction value of their sales. This rule came into force in October 2018. The rate for TCS in this situation would be 1% (0.5% CGST + 0.5% SGST). Alternatively, it could also be 1% of IGST.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.