Loading

Get Adp Prototype Plan Hardship 257

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Adp Prototype Plan Hardship 257 online

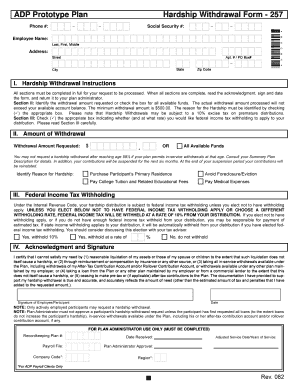

The Adp Prototype Plan Hardship 257 form is essential for users seeking a hardship withdrawal from their retirement plan. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your hardship withdrawal request.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your personal information at the top of the form, including your employee name, social security number, address, and phone number. Ensure all details are accurate and current.

- Navigate to Section I: Hardship Withdrawal Instructions. Carefully read through the instructions to understand the requirements for your request. All sections of the form must be completed for processing.

- Proceed to Section II: Amount of Withdrawal. Here, specify the withdrawal amount you are requesting, ensuring it is at least $500. Alternatively, you can check the box for all available funds.

- Identify the reason for your hardship by checking the appropriate box for one of the listed options, such as purchasing a primary residence or paying medical expenses.

- In Section III: Federal Income Tax Withholding, indicate whether you would like federal income tax withholding to apply to your distribution. You can choose to withhold 10% or specify a different rate.

- Read the acknowledgment carefully. By signing, you certify that you have explored all available financial options and that the documentation you provided is accurate.

- Date and sign the form at the bottom of Section IV: Acknowledgment and Signature. Make sure your signature is legible.

- Upon completing your form, review all entries for accuracy. Once you are satisfied, save changes, and prepare to download, print, or share the completed form as necessary.

Take action now to complete your Adp Prototype Plan Hardship 257 form online.

Depending on whether your plan permits borrowing, you're generally allowed to take up to 50 percent of your vested account balance to a max of $50,000 whichever is less. You have five years to repay the loan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.