Loading

Get #6305 Roth Ira Direct Conversion Request (12010)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the #6305 Roth IRA Direct Conversion Request (12010) online

Navigating the #6305 Roth IRA Direct Conversion Request can be straightforward when you understand each component. This guide provides clear, step-by-step instructions to assist users in completing the form online successfully.

Follow the steps to correctly fill out the form

- Click ‘Get Form’ button to access the form online and open it in your preferred editor.

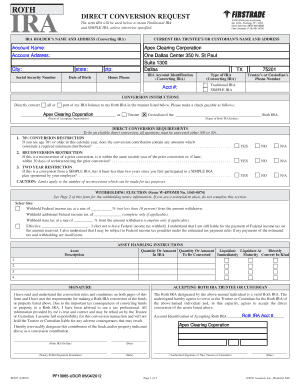

- Begin by entering your name and address in the designated 'IRA holder’s name and address (Converting IRA)' section. Ensure accuracy in spelling and format.

- In the 'Current IRA trustee’s or custodian’s name and address' section, provide the required contact details of your existing IRA account custodian.

- Fill out your Social Security number, date of birth, and home phone number. These identifiers are essential for accurately processing your request.

- Identify your IRA account by entering the account number in the 'IRA Account Identification (Converting IRA)' field.

- Select the type of IRA you are converting from by checking the appropriate box for either 'Traditional IRA' or 'SIMPLE IRA.'

- In the 'Conversion instructions' section, indicate whether you want to convert all or part of your IRA balance to your Roth IRA. Specify the amount or leave it blank for a full conversion.

- Designate the name of the accepting organization and Roth IRA holder in the appropriate fields.

- Answer the direct conversion requirements questions carefully, ensuring that you respond with 'NO' or 'N/A' as applicable to ensure your eligibility.

- Complete the withholding election section if it applies to your situation, specifying the federal and state withholding rates as necessary.

- Provide asset handling instructions, detailing whether to liquidate or convert assets in kind, along with the amount.

- Sign and date the form to confirm your understanding of the conversion rules and your intention to conduct the conversion.

- If applicable, have the accepting Roth IRA trustee or custodian sign and date the document as well.

- Finally, upon completion of all fields, save your changes, download the form, print it, or share it as required.

To ensure a smooth process, complete your #6305 Roth IRA Direct Conversion Request online today.

If you meet one or more of these criteria, consider a Roth conversion in 2020: Your IRA balance is over $500,000. You are over age 70½ (or turned 72 in 2020), and do not have to take your required minimum distribution (RMD) in 2020. You expect your 2020 taxable income to be lower than your 2019 taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.