Loading

Get 2014 Hsa Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 HSA Application online

Filling out the 2014 Health Savings Account (HSA) Application online is a straightforward process. This guide will provide you with clear, step-by-step instructions to help you complete the application accurately and efficiently.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the application form and launch it in your preferred online editor.

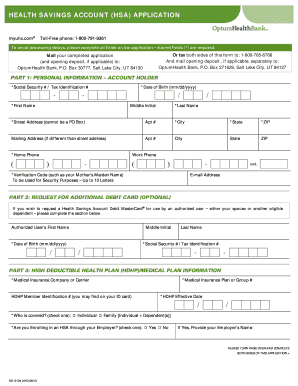

- Begin filling out Part 1: Personal Information – Account Holder. Ensure to enter your Social Security Number, date of birth, first name, middle initial, last name, street address (no PO Boxes), city, state, ZIP code, home phone number, and e-mail address. Fields marked with an asterisk (*) are required.

- If you wish to request an additional debit card for an authorized user, proceed to Part 2. Fill in the authorized user's first name, middle initial, date of birth, last name, and Social Security Number.

- In Part 3, provide information related to your high deductible health plan (HDHP). This includes the medical insurance company or carrier, plan or group number, HDHP member identification number, effective date, and indicate whether you are enrolling in an HSA through your employer. If yes, include your employer’s name.

- Complete Part 4 by providing beneficiary information if you wish to designate an alternative beneficiary. If not designated, your estate will be the default beneficiary.

- In Part 5, carefully read through the signature requirements and statements. Once you have reviewed everything, sign and date the application. Ensure your signature is included as it is required for processing.

- If applicable, complete Part 6 by indicating whether you are enclosing an opening deposit with your application. If yes, write the amount and make sure to include your name and Social Security Number on the check.

- After completing all required fields and sections, you may choose to save your changes, download, print, or share the form directly from your online editor.

Complete your 2014 HSA Application online today and ensure all your information is submitted accurately.

At age 65, most Americans lose HSA eligibility because they begin Medicare. Final Year's Contribution is Pro-Rata. You can make an HSA contribution after you turn 65 and enroll in Medicare, if you have not maximized your contribution for your last year of HSA eligibility.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.