Loading

Get Lump Sum Distribution Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lump Sum Distribution Form online

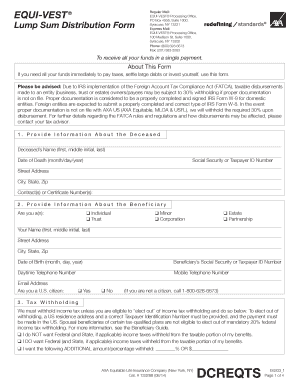

The Lump Sum Distribution Form is designed for individuals seeking to receive their funds in a single payment. This guide provides step-by-step instructions for completing the form online, ensuring a smooth process for users.

Follow the steps to successfully complete your Lump Sum Distribution Form

- Press the ‘Get Form’ button to secure the form and access it in the online editor.

- Begin by providing information about the deceased. Fill in their full name, date of death, and social security or taxpayer ID number. Also include their street address, city, state, zip code, and any contract or certificate numbers associated with their account.

- Next, provide information about the beneficiary. Indicate whether you are an individual, trust, minor, corporation, estate, or partnership. Enter your full name, address, date of birth, social security or taxpayer ID number, and contact numbers.

- Address the tax withholding section. Decide if you want any federal and state taxes withheld from your benefits. If electing out of withholding, make sure to provide a valid U.S. residence address and taxpayer identification number.

- Choose your payment option. Select if you want to receive a lump sum check or if you wish for an Access Account to be established on your behalf. Specify how you would like the payment delivered.

- Read and sign the form. By signing, you certify that the provided taxpayer identification number is correct and confirm that you are not subject to backup withholding.

- Select any expedited delivery options if needed, and provide relevant bank details if choosing to expedite payment via wire transfer.

- Review all provided information for accuracy, then save your changes. You can download, print, or share the completed form as required.

Complete your Lump Sum Distribution Form online today for a seamless distribution experience.

Use Form 4972 to figure the tax on a qualified lump-sum distribution (defined below) you received in 2020 using the 20% capital gain election, the 10-year tax option, or both.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.