Loading

Get What Is Business Application Payroll Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is Business Application Payroll Form online

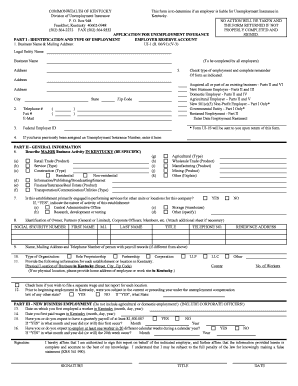

The What Is Business Application Payroll Form is essential for determining if an employer is liable for Unemployment Insurance in Kentucky. This guide will provide a clear and supportive overview of the steps necessary to complete the form online, ensuring that you understand each component.

Follow the steps to complete your form accurately

- Click 'Get Form' button to access the document and open it in your preferred editor.

- In Part I, provide your business name and mailing address, including the legal entity name and the physical address. Ensure that all fields are accurately filled out.

- Check the type of employment that applies to your business and complete the necessary subsequent parts of the form as indicated.

- For general information in Part II, describe your major business activities in Kentucky, selecting from the provided categories.

- In Part II, indicate whether the establishment is primarily engaged in performing services for other units or locations, and provide details if applicable.

- List the identification details of owners, partners, or corporate officers, and make sure to include their social security numbers and contact information.

- Continue filling out the details for each establishment or location in Kentucky, specifying the physical address and number of workers.

- If applicable, provide information regarding the new business employment, including dates of employment and wages paid in Kentucky.

- Complete the section pertaining to domestic employment if your business includes household workers.

- If your business involves agricultural employment, provide the required dates and payroll information.

- Fill out the acquisition of existing business section if relevant, including details of the transfer and new ownership.

- Finally, review all entered information for accuracy, and then save your changes, or choose to download, print, or share the form as needed.

Take action now by completing your forms online to ensure compliance and efficiency.

Go to the Reports menu. Find the Payroll section, then Payroll Summary by Employee. Set a date range from the dropdown. Select the single employee or group of employees. Choose how you'd like your columns to be viewed by (by employee, weekly, bi-weekly, etc).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.