Loading

Get Real Estate Errors And Omission Liability Application General ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the REAL ESTATE ERRORS AND OMISSION LIABILITY APPLICATION online

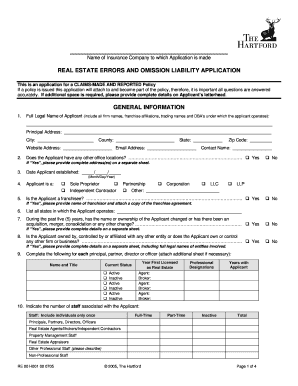

This guide will assist you in accurately completing the Real Estate Errors and Omission Liability Application online. Filling out this application correctly is crucial, as it forms part of your insurance policy if issued.

Follow the steps to fill out the application effectively.

- Click ‘Get Form’ button to acquire the application and open it in your preferred online editor.

- Provide the full legal name of the applicant, including all firm names and trading names. Make sure to include the principal address, city, county, state, and zip code.

- Enter the date the applicant was established in the month/day/year format.

- Select the appropriate business type from the options given such as Sole Proprietor, Partnership, Corporation, etc. Indicate if the applicant is a franchisee and provide the name of the franchisor if applicable.

- List all states where the applicant operates. This is important for compliance with local regulations.

- Answer questions relating to changes in ownership or structure over the past five years, including mergers or acquisitions.

- Provide contact information for the applicant, including the contact name, email address, and website address.

- Specify the number of associated staff, categorized by full-time, part-time, and inactive status. Consider all individuals only once.

- Detail any training and risk management procedures in place by selecting 'Yes' or 'No'. Include information about in-house legal counsel if applicable.

- Indicate any professional real estate services provided on properties of interest to the applicant. If the answer is 'Yes', report the gross income generated from these activities.

- Complete the insurance coverage history section by listing your prior professional liability insurance details over the last five years.

- Address any claims or incidents that may have occurred within the past five years, providing pertinent details for each claim.

- Select the limits of liability and deductible amounts. Choose any optional coverages desired for your policy.

- Before submission, ensure all questions are answered accurately and check for any additional documentation required.

- Finally, review your application for completeness, sign and date the form, then save changes, download, print, or share the completed form online.

Start filling out your application online now to secure your real estate errors and omissions liability coverage.

The median cost of errors and omissions insurance for real estate businesses is about $55 per month, or $665 annually. This policy, also known as professional liability insurance, can protect your business from work mistakes that negatively impact clients.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.