Loading

Get How To Fill Up Form No 15h See Section 197a1c And Rule 29c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Up Form No 15h See Section 197a1c And Rule 29c online

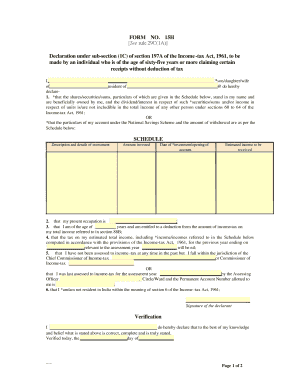

Filling out Form No. 15H is essential for individuals aged sixty-five and older who wish to claim certain receipts without the deduction of tax. This comprehensive guide will walk you through the online submission process, helping you understand each component of the form.

Follow the steps to successfully complete the form online.

- To begin, click the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- In the first section, you will enter your full name and relationship to the person filling out the form, such as 'son,' 'daughter,' or 'partner.' Ensure you provide a complete postal address in the designated area.

- Next, you will select between declaring the shares, securities, or sums that you beneficially own, or providing details about your account under the National Savings Scheme, along with the withdrawal amount. Fill in the relevant details in the Schedule below.

- Indicate your present occupation in the designated field, and verify your age by entering the number of years you have lived.

- You will need to confirm your tax deduction eligibility by stating that your estimated total income, including the income specified earlier, is computed as nil. This indicates you are not liable for income tax based on your total income for the specified previous year.

- If applicable, indicate whether you have previously been assessed to income tax and provide your Permanent Account Number (PAN) alongside details of the last assessment, if relevant.

- You will also need to clarify your residency status in India, marking the appropriate checkbox according to your situation.

- Sign the declaration to verify that the information is accurate and complete. Ensure the verification date is filled out properly.

- Finally, review all the entered information. Once confirmed, you may save the changes, download the completed form, print it for your records, or share it as needed.

Start completing your documents online today for a seamless filing experience.

Form 15H can only be submitted by an individual who has reached the age of 60 years and above i.e. senior citizens. Other individuals/HUFs are required to submit Form 15G in order to prevent TDS deduction. Form 15H can only be submitted by Indian citizens residing in India. It is not applicable to NRIs or foreigners.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.