Loading

Get Form A-1 (10-12) Petition Of Appeal Appeal Number County ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form A-1 (10-12) PETITION OF APPEAL Appeal Number COUNTY ... online

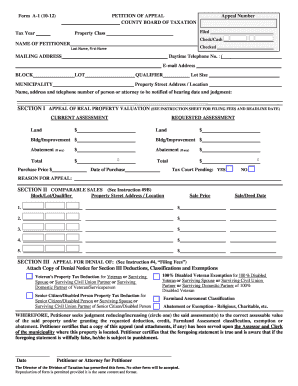

This guide provides a comprehensive overview of how to accurately complete the Form A-1 (10-12) PETITION OF APPEAL online. Whether you are seeking to challenge a real property valuation or address a denial of property tax deductions, following these steps will help ensure your petition is properly filled out and submitted.

Follow the steps to successfully complete your petition of appeal.

- Click the ‘Get Form’ button to access the form. This will allow you to open it in a suitable editor where you can input your information.

- Begin by filling out the appeal number and county at the top of the form. This information is crucial for tracking your petition and identifying the jurisdiction.

- Indicate the tax year relevant to your appeal. This helps establish the timeline for your request.

- Provide the name of the petitioner. Ensure you format it as Last Name, First Name to avoid confusion.

- Enter your mailing address, daytime telephone number, and email address for contact purposes. Accurate contact information is essential for receiving updates regarding your appeal.

- Fill in the appropriate details regarding the property, including block, lot, and qualifier numbers, as well as the municipality and lot size.

- In Section I, specify the current assessment and requested assessment for land and any buildings or improvements on the property. Include amounts in the provided fields.

- State the reason for your appeal in the designated section. Providing a clear rationale increases the likelihood of a favorable outcome.

- Complete Section II by entering the details of comparable sales, including addresses, sale prices, and deed dates. Limit your entries to five comparable properties for best practice.

- If applicable, fill out Section III for any denials related to tax deductions. Attach the necessary denial notice as specified.

- Confirm the accuracy of all entered information and provide your signature along with the date at the bottom of the form. If you are represented by an attorney, include their signature and credentials.

- Finally, save your changes, and consider downloading, printing, or sharing the form as needed to ensure submission to the county board of taxation.

Complete your Form A-1 online today to move forward with your appeal efficiently.

You can appeal an added or omitted assessment by filing Form AA-1 with your County Board of Taxation. NOTE: If the aggregate assessed valuation of the property exceeds $750,000, the appeal may be made directly to the Tax Court of New Jersey.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.