Loading

Get Business Tax Certificate Number

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Business Tax Certificate Number online

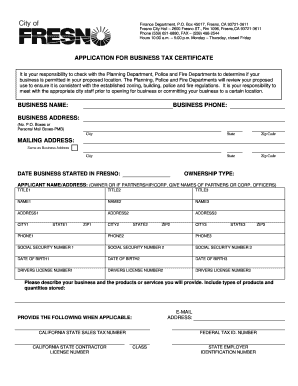

Filling out the Business Tax Certificate Number online is an essential step in legally establishing your business in Fresno. This guide provides clear instructions on how to effectively complete the form, ensuring you provide all necessary information accurately.

Follow the steps to complete your Business Tax Certificate Number application online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your business name in the designated field. This is the registered name of your business.

- Provide your business phone number. This should be a direct line to your business.

- Fill in your business address. Remember, P.O. boxes or personal mailboxes are not permitted. Make sure to include city, state, and zip code.

- If your mailing address is the same as your business address, check the appropriate box. Otherwise, provide your mailing address including city, state, and zip code.

- Indicate the date your business started operating in Fresno.

- Select your ownership type, such as sole proprietorship, partnership, or corporation.

- Complete the applicant name/address section. Include the names and addresses of all owners or partners of the business.

- Input social security numbers and dates of birth for all owners or partners listed.

- Provide drivers license numbers for all listed individuals.

- Describe your business and the products or services you will provide. Be specific about types of products and quantities stored.

- Enter your email address for correspondence related to your application.

- When applicable, provide your California State Sales Tax Number, State Contractor License Number, Federal Tax ID Number, and State Employer Identification Number.

- Check any boxes that apply to the operations of your business, such as 'Taxi Cab Company' or 'Mobile Vendor'.

- Select the type of business by checking one of the options such as wholesale, retail, or service.

- If your business location has a previous use, provide details in the specified field.

- List the name and address of the landlord/property owner if your business is located at a commercial location.

- If you know your NAIC code, provide it in the designated space.

- Indicate the number of employees, specifying full-time and part-time workers.

- Estimate the current year gross receipts for your business in Fresno.

- If applicable, indicate if you sell products outside of California and provide the estimated gross value of these exports.

- Acknowledge receipt of the supplemental ‘New Business Information Checklist’.

- Certify the accuracy of the information provided, signing and dating the application appropriately.

- After completing all sections, review your information for accuracy. You can then save changes, download, print, or share the form.

Ready to complete your Business Tax Certificate Number? Start the application process online today.

BUSINESS TAX REGISTRATION CERTIFICATE (BTRC) NUMBER. Page 1. BUSINESS TAX REGISTRATION CERTIFICATE (BTRC) NUMBER. The City of Los Angeles, Office of Finance requires all firms that engage in any business activity within the City of Los Angeles to pay City business taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.