Loading

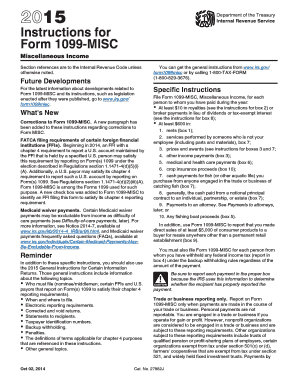

Get 2015 Instructions For Form 1099-misc - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 instructions for Form 1099-MISC - Internal Revenue Service - IRS online

Filling out Form 1099-MISC correctly is essential for reporting miscellaneous income. This guide will walk you through the process of filling out the 2015 instructions for Form 1099-MISC online, ensuring compliance with IRS requirements and clear understanding of the necessary components.

Follow the steps to complete your Form 1099-MISC accurately online.

- Press the ‘Get Form’ button to retrieve the form and open it in the editing tool.

- Provide your payer’s information, including the name, address, and taxpayer identification number (TIN) in the designated fields. Ensure that each entry is accurate to avoid complications.

- Enter the recipient's information: include their name, address, and TIN. This information is crucial for identification purposes and reporting to the IRS.

- Fill out the appropriate boxes depending on the type of payments made. For example, report rents in box 1 and nonemployee compensation in box 7. Each box corresponds to different categories of income—make sure to refer to the instructions if uncertain about what to include.

- Double-check the total amounts for each box to ensure accuracy. Mistakes could lead to issues with the IRS and the recipient.

- Once all information is completed, review the entire form for any errors or omissions before finalizing.

- Save your changes to the form, and if necessary, download a copy for your records. You may also choose to print the form or share it digitally as required.

Complete your forms online now to ensure timely and accurate reporting.

If you receive the missing or corrected Form W-2 or Form 1099-R after you file your return and the information differs from your estimates, you must file Form 1040-X, Amended U.S. Individual Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.