Loading

Get Possessory Interests Annual Usage Report Form Boe-502-p - Smcare

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Possessory Interests Annual Usage Report Form BOE-502-P - Smcare online

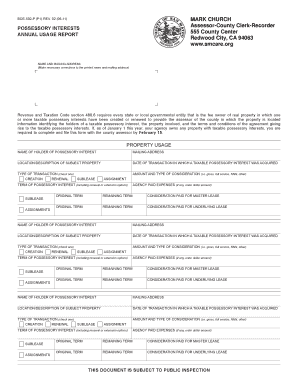

Filling out the Possessory Interests Annual Usage Report Form BOE-502-P is a crucial step for every state or local governmental entity that owns real property with taxable possessory interests. This guide will help you navigate the process with ease and confidence.

Follow the steps to successfully complete your form.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Begin by reviewing the pre-printed name and mailing address. Make any necessary corrections to ensure accuracy.

- In the property usage section, fill in the name of the holder of the possessory interest, followed by their mailing address.

- Provide a detailed location or description of the subject property in the designated field.

- Enter the date of the transaction in which the taxable possessory interest was acquired.

- Select the type of transaction from the provided options, indicating whether it's a creation or renewal.

- Detail the amount and type of consideration, whether it is gross, full service, NNN, or other, and specify if it involves sublease or assignment.

- Indicate the term of the possessory interest, including any renewal or extension options.

- If applicable, enter the agency-paid expenses in the designated field.

- Complete sections outlining the original term and remaining term of the master lease and the underlying lease, including consideration paid.

- Finish by completing the certification at the end of the form. The agency representative or preparer must sign, date, and provide their title and contact information.

- Once all sections are completed, review your entries for accuracy before saving your changes, downloading, printing, or sharing the form.

Complete your documents online with confidence and ensure timely submission.

California's property tax rate is 1% of assessed value (also applies to real property) plus any bonded indebtedness voted in by the taxpayers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.