Loading

Get 2002 Schedule C (form 1040) (fill-in Version) - Taxboard

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2002 Schedule C (Form 1040) (Fill-in Version) - Taxboard online

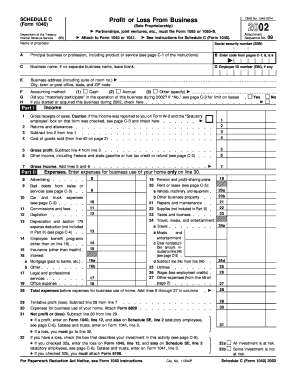

Filling out the 2002 Schedule C (Form 1040) is essential for people operating a sole proprietorship to report income and expenses. This guide provides clear instructions to help users navigate the form seamlessly and accurately.

Follow the steps to fill out your Schedule C form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as the proprietor in the designated field. Ensure that the name matches the name on your Social Security card.

- Input your Social Security number (SSN) in the corresponding field.

- Describe your principal business or profession, including the product or service you provide. Refer to the code list on pages C-7, 8, and 9 to select an appropriate business code.

- If applicable, enter your business name. If you do not have a separate business name, you may leave this field blank.

- Fill in your Employer Identification Number (EIN), if you have one.

- Provide your business address, including suite or room number, city, state, and ZIP code.

- Indicate your accounting method by selecting cash, accrual, or other, and specify if you began or acquired this business during 2002.

- Complete Part I by entering gross receipts or sales, cost of goods sold, and then determining your gross profit and total income.

- List all relevant expenses in the appropriate fields from lines 8 through 27, making sure to differentiate between business and personal expenses.

- Calculate total expenses, including those for business use of your home, and record this information in the designated sections.

- Finally, determine your net profit or loss. If you have a profit, enter it on Form 1040, line 12. If there is a loss, follow the specified instructions to carry this forward.

- Review all entries for accuracy and completeness.

- Once satisfied with the form, users can save changes, download, print, or share the completed Form.

Start filling out your Schedule C form online today to ensure timely and accurate reporting of your business income and expenses.

For tax year 2019 and later, you will no longer use Schedule C-EZ, but instead use the Schedule C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.