Loading

Get Sa103f

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sa103f online

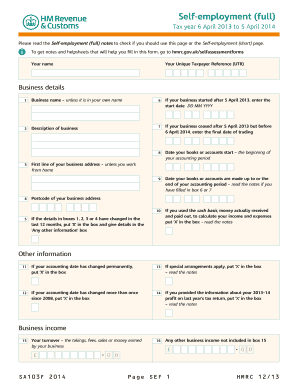

The Sa103f form is designed for self-employed individuals to report their income and expenses for tax purposes. Completing this form accurately is essential for ensuring compliance with tax regulations and maximizing any potential claim for allowances.

Follow the steps to complete your Sa103f form online

- Press the ‘Get Form’ button to obtain the Sa103f form and open it in your preferred online editor.

- Fill in your name in the designated field. Ensure that it matches the name on your tax records.

- Enter your Unique Taxpayer Reference (UTR) in the appropriate box. This is a 10-digit number provided by HMRC.

- In the 'Business details' section, enter your business name, unless it is your own name.

- Provide a description of your business in the field provided.

- If your business started after 5 April 2013, specify the start date in the DD MM YYYY format.

- If your business ceased after 5 April 2013 but before 6 April 2014, enter the final trading date.

- Indicate the date your books or accounts start, marking the beginning of your accounting period.

- Specify the date your books or accounts are made up to, which should reflect the end of your accounting period.

- If you used the cash basis for calculating income and expenses, place an 'X' in the appropriate box.

- In the 'Business income' section, record your turnover, representing your total income from the business.

- Document total business expenses in the relevant field and categorize them as necessary.

- Calculate and enter your net profit or loss based on the difference between business income and expenses.

- Complete the tax allowances for vehicles and equipment in the applicable sections, understanding capital allowances.

- If you have made any adjustments necessary due to disallowable expenses or further tax calculations, fill out the relevant boxes.

- Review all information entered for accuracy before proceeding to the next step.

- Once you have completed the form, you can save your changes, download, print, or share the Sa103f form as needed.

Begin filling out your Sa103f form online today to ensure your tax compliance.

The short tax return (SA200) is a four-page form which aims to use simpler language than the main self-assessment return. Because the form only contains a limited number of questions, it is only being issued to those whose affairs HMRC believe are straightforward. ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.