Loading

Get Deduction For Personal Super Contributions Form - Prime Super

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deduction For Personal Super Contributions Form - Prime Super online

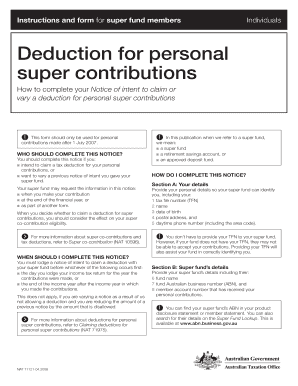

Filling out the Deduction For Personal Super Contributions Form is essential for individuals who wish to claim a tax deduction for their personal contributions. This guide provides a clear and supportive approach to assist users in accurately completing the form online.

Follow the steps to successfully fill out your Deduction For Personal Super Contributions Form.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- In Section A: Your details, enter your tax file number, name, date of birth, postal address, and daytime phone number. Providing your TFN helps your super fund verify your identity.

- In Section B: Super fund’s details, input your fund's name, Australian business number (ABN), and your member account number to ensure accurate processing.

- In Section C: Contribution details, indicate the financial year for your personal contributions and specify the amount for which you are claiming a deduction. If you are varying a previous notice, select the applicable box.

- In Section D: Declaration, choose your declaration type, either 'Intention to claim a tax deduction' or 'Variation of previous deduction notice.' Print your name, sign, and date the declaration.

- Once all sections are completed, save your changes. You can then download, print, or share the completed form as needed.

Complete your Deduction For Personal Super Contributions Form online today.

Most Australians know that super is money for retirement. What's less well known is that you don't solely have to rely on your bosses' contributions to grow your super savings. Better still, money you add to super from your own pocket (post-tax) can be tax deductible.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.