Loading

Get Cp30 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cp30 Form online

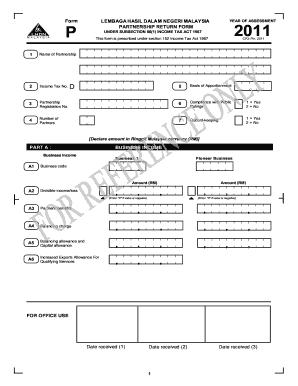

Filling out the Cp30 Form online can streamline the process of submitting your partnership return. This guide provides a clear, step-by-step approach to help you complete each section of the form accurately.

Follow the steps to complete the Cp30 Form accurately online.

- Press the ‘Get Form’ button to access the Cp30 Form in your browser. This will allow you to view and edit the form online.

- Begin with the first section, which requires you to enter the name of the partnership. Clearly fill in the correct name to ensure accurate identification.

- Input the Income Tax Number associated with the partnership in the designated field. This number is essential for tax identification.

- Enter the Partnership Registration Number, which is necessary for legal compliance. This number is crucial for verifying the legitimacy of the partnership.

- Specify the number of partners involved in the partnership. This information is vital for tax allocation purposes.

- Provide the year of assessment for which the form is being submitted. Ensure that you select the correct year to maintain accurate records.

- Proceed to detail the basis of apportionment in the respective section. This involves providing information on income distribution among partners.

- Indicate your compliance status with public rulings by choosing 'Yes' or 'No.' This will assist in determining adherence to tax regulations.

- Complete the record-keeping section by selecting 'Yes' or 'No' to show whether proper records are maintained for the partnership.

- Continue filling out the business income sections, entering amounts relevant to your partnership activities, ensuring accurate completion for each category.

- Once all sections are filled out, review your entries for accuracy. It is crucial to ensure that all information is correct before final submission.

- Finally, save your changes and choose to download or print the completed form. You may also share it as required for your records or submission.

Complete your partnership return by filling out the Cp30 Form online today for a hassle-free experience!

The IRS now sends CP303 notices to taxpayers when their information is used for accessing IRS applications, including the irs.gov website, with the ID.me third-party identity verification service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.