Loading

Get 3415 Fr.01 International Information Form (iif) & Substitute ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 3415 FR.01 International Information Form (IIF) & Substitute IRS Form W-8 BEN online

This guide provides a step-by-step approach to completing the 3415 FR.01 International Information Form (IIF) & Substitute IRS Form W-8 BEN online. Designed for users with varying levels of experience, this guide will help ensure that you fill out the form accurately and efficiently.

Follow the steps to complete the International Information Form online.

- Start by locating the form. Press the ‘Get Form’ button to obtain the 3415 FR.01 International Information Form and open it in your preferred editor.

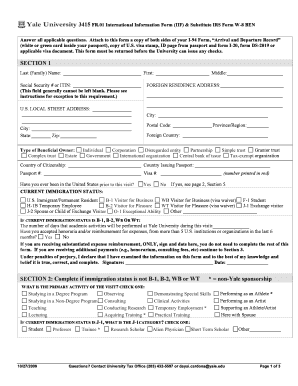

- Section 1 requires you to enter your last (family) name, first name, and middle name. Fill in your foreign residence address and, if applicable, your Social Security Number or ITIN. Make sure to provide your U.S. local street address, city, state, and zip code.

- Indicate the type of beneficial owner by selecting one from the provided options like Individual, Corporation, or Government. Specify your country of citizenship and the country issuing your passport.

- Complete your current immigration status by selecting the appropriate option from the list provided. If you have been in the United States previously, answer the follow-up question accordingly.

- If your immigration status is B-1, B-2, WB, or WT, specify the number of days you will perform academic activities and answer whether you have accepted payments from more than five U.S. institutions in the last six months.

- In Section 2, check the box that corresponds to your primary activity during your visit. This could be studying or conducting research, among others.

- Section 3 requires accurate dates for your entry into the U.S. and your non-immigrant status. You will also state your income-providing activity and source of funding.

- In Section 4, if claiming tax treaty benefits for non-service payments, check the applicable boxes and provide details as required.

- Fill out Section 5 if you have previous visa immigration activities, specifying the date of entry and exit, along with your visa status.

- Complete the resident alien/nonresident alien determination in Section 6. You will find guidelines to help you establish your residency status for tax purposes.

- Finally, review all sections of the form for accuracy and completeness. Once you are satisfied with the information provided, you can save changes, download, print, or share the completed form.

Complete your 3415 FR.01 International Information Form online with ease today!

Definition(s): Any representation of information that permits the identity of an individual to whom the information applies to be reasonably inferred by either direct or indirect means.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.