Loading

Get Spokane Board Of Equalization Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Spokane Board of Equalization Form online

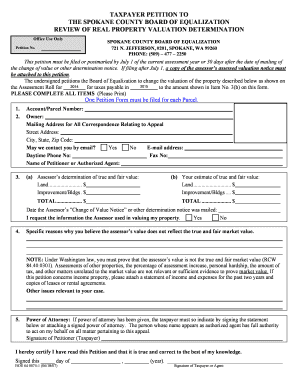

Filling out the Spokane Board of Equalization Form online can seem daunting, but this guide is designed to help you navigate the process with ease. Follow our step-by-step instructions to ensure that your petition is complete and accurately reflects your request for a review of your property valuation.

Follow the steps to complete the Spokane Board of Equalization Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your account or parcel number, which is found on your determination notice, value change notice, and tax statement. If you are appealing multiple parcels, remember to submit a separate petition for each one.

- Fill in your name as the owner of the property and provide a complete mailing address for correspondence relating to your appeal, including street address, city, state, and zip code.

- Indicate if you wish to be contacted by email by selecting 'Yes' or 'No'. Additionally, provide your fax number and daytime phone number for further communication.

- Complete the valuation sections accurately. Enter the assessor's determination of true and fair value for both land and improvements, and provide your own estimate for these categories.

- Indicate the date the Assessor’s Change of Value Notice or other determination notice was mailed to you, and check if you are requesting the information that the Assessor used for valuation.

- Provide specific reasons why you believe the assessor's value is incorrect. Remember, you must prove that the assessor's value does not reflect the true and fair market value.

- If applicable, sign the Power of Attorney section, indicating if someone is acting on your behalf.

- Complete the property description section, checking all that apply: farm, residential, commercial, industrial, etc., and provide additional details like address, lot size, and zoning.

- Check whether your property has been appraised by someone other than the County Assessor and provide the details if applicable.

- Indicate your intent regarding the submission of additional documents, confirming if you will provide more evidence before the hearing.

- Review your form for any missing information, ensuring all required fields are filled accurately.

- Once completed, save your changes, then download or print the form. Make sure to send the original signed petition with any required attachments to the Spokane County Board of Equalization.

Ready to get started? Fill out the Spokane Board of Equalization Form online today!

The Senior Citizens Real Estate Tax Deferral Program provides tax relief for qualified senior citizens by allowing them to defer all or part of their property tax and special assessment payments on their principal residences. This is a loan program through the State of Illinois.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.