Loading

Get Fill-in Form - Wisconsin Department Of Revenue - Revenue Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fill-In Form - Wisconsin Department Of Revenue - Revenue Wi online

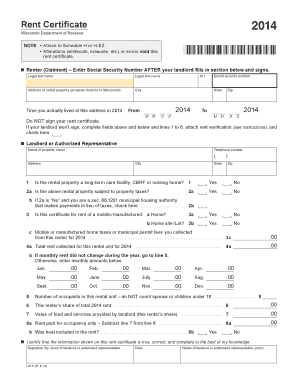

This guide provides detailed, user-friendly instructions for completing the Fill-In Form from the Wisconsin Department of Revenue. Whether you are a renter or landlord, you will find clear steps to ensure your form is filled out accurately and completely.

Follow the steps to successfully complete the Fill-In Form.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your legal last name, legal first name, and middle initial in the designated fields. Make sure to use your full legal name as it appears on your identification.

- Provide the address of your rental property. Ensure that this property is located in Wisconsin, including the city, state, and zip code.

- Indicate the time you lived at this address in 2014 by filling out the respective fields for the start and end dates.

- Enter your social security number only after your landlord has filled in their section and signed the form.

- If your landlord will not sign the rent certificate, complete the fields above and check the designated box.

- Next, your landlord or authorized representative will fill their details, including their name, telephone number, and address.

- Proceed to answer the yes or no questions regarding the rental property, including whether it is subject to property taxes and if it is a long-term care facility.

- Provide detailed rent information, including total rent collected for 2014 and the monthly breakdown if applicable.

- Complete all additional sections regarding shared living expenses if there are other occupants. Enter the shared living expenses paid by all occupants and your contribution.

- Finally, review all sections to ensure accuracy and completeness. If all fields are filled correctly, save your changes, download, print, or share the form as needed.

Complete your Fill-In Form online today and ensure your submission is thorough and accurate.

Electronic Federal Tax Payment System (EFTPS) is for individual and business taxpayers to pay federal taxes electronically online or by phone for free. To enroll or for more information, taxpayers should visit EFTPS.gov or call 800-555-4477.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.