Loading

Get 07/05) Cert-138 Purchases For Use In Audio Or Video Production Or Broadcasting General Purpose: The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 07/05) CERT-138 Purchases For Use In Audio Or Video Production Or Broadcasting General Purpose: The online

Filling out the CERT-138 form is a crucial step for businesses involved in audio or video production, enabling them to claim tax exemption for eligible purchases. This guide will walk you through the process of completing the form online, ensuring clarity and compliance with relevant regulations.

Follow the steps to successfully complete the CERT-138 form.

- Click the ‘Get Form’ button to access the CERT-138 form and open it in your chosen online editor.

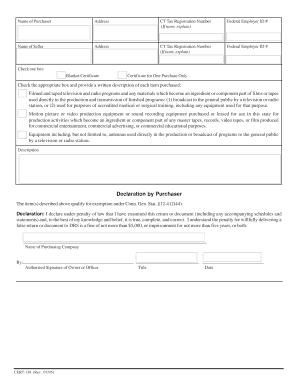

- Enter the name of the purchaser in the designated field at the top of the form. This should be the name of the business or individual making the purchase.

- Fill in the address of the purchaser, including street address, city, state, and zip code.

- If the purchaser has a Connecticut tax registration number, enter it into the specified field. If not, provide an explanation as required.

- Include the federal employer identification number (EIN) of the purchaser in the relevant section.

- Enter the name of the seller in the corresponding field, followed by the seller's address.

- If the seller has a Connecticut tax registration number, enter it; otherwise, provide an explanation.

- Fill in the federal employer identification number (EIN) for the seller.

- Select one box to indicate whether this form is a 'Blanket Certificate' or 'Certificate for One Purchase Only' based on your purchasing needs.

- Check the appropriate box and provide a description of each item purchased that qualifies for exemption, ensuring it aligns with the listed categories.

- Include a declaration confirming that the items qualify for exemption under Conn. Gen. Stat. §12-412(44).

- Sign the document with the name of the purchasing company and include the authorized signature of the owner or officer.

- Finally, date the form before saving, downloading, printing, or sharing your completed CERT-138 form.

Complete your documents online to ensure a smooth purchasing process.

How long is my Connecticut sales tax exemption certificate good for? Most blanket exemption certificates is considered to be valid for precisely three years from the from the date that they were issued, so long as the tax exempt situation is still in effect.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.