Loading

Get Form 200.pdf - Office Of The Navajo Tax Commission

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 200.pdf - Office Of The Navajo Tax Commission online

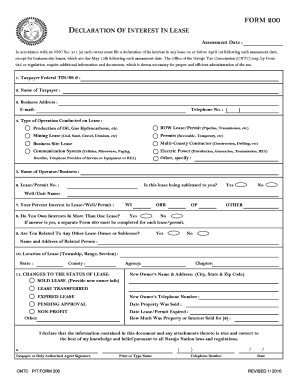

This guide provides clear and supportive instructions on how to successfully complete the FORM 200, also known as the Declaration of Interest in Lease, for submission to the Office of the Navajo Tax Commission. Whether you are a first-time filer or have experience, this step-by-step approach will assist you in submitting the form online with confidence.

Follow the steps to effectively complete the FORM 200 online.

- To obtain the form, please click the ‘Get Form’ button to access and open FORM 200 in your editor.

- Begin filling out the form by entering your Taxpayer Federal TIN or Social Security number in the appropriate field.

- Provide your full name as the taxpayer in the next section, ensuring that it matches official documents.

- Fill in your complete business address, including street name, city, state, and zip code.

- Enter your email address and telephone number, ensuring the contact information is accurate for future correspondence.

- Select the type of operation you are conducting on the lease from the given options, such as production of oil or gas, mining leases, or other specified types.

- Provide the name of the operator or business associated with the lease and enter the lease or permit number.

- Indicate whether the lease is being subleased to you by selecting 'Yes' or 'No.' If yes, provide the well or unit name associated with the lease.

- Input your percent interest in the lease, well, or permit using the sections designated for Working Interest (WI), Ordinary Royalty Rights (ORR), or other applicable categories.

- Respond to whether you own interests in more than one lease. If you select 'Yes,' a separate FORM 200 must be filled out for each additional lease or permit.

- If applicable, indicate whether you are related to any other lease owner or sublessee, and provide the name and address of the related person.

- Fill in the location of the lease, including township, range, section, state, and county, and note the agency overseeing the lease.

- Report any changes to the status of the lease, specifying whether it has been sold, transferred, expired, or is pending approval. Provide relevant dates and new owner information where necessary.

- After completing all sections, review your entries for accuracy, and then you have the option to save changes, download, print, or share the form as needed.

Complete and submit your FORM 200 online today to ensure compliance with the Navajo Tax Commission requirements.

Statewide, the highest combined rates, 11.2 percent, are in Superior and Mammoth, both in Pinal County. The lowest rate, 7.6 percent, is in Huachuca City, near the Fort Huachuca military base.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.