Loading

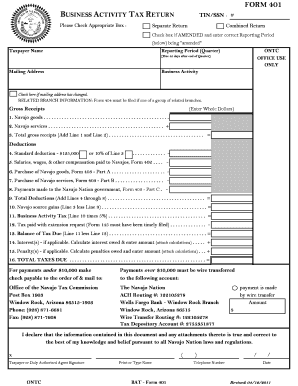

Get Form 401 - Office Of The Navajo Tax Commission

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 401 - Office Of The Navajo Tax Commission online

Filling out the Form 401 - Office Of The Navajo Tax Commission is essential for businesses operating within the Navajo Nation. This guide will provide clear and step-by-step instructions to help you accurately complete the form online, ensuring compliance with tax regulations.

Follow the steps to complete the Form 401 with ease.

- Click 'Get Form' button to access the form and open it in your preferred document editor.

- Start by checking the appropriate box to indicate whether you are filing a separate or combined return. If you are amending a prior return, check the box for 'AMENDED' and provide the correct reporting period.

- Enter your taxpayer name and mailing address accurately in the designated fields. Ensure that your mailing address is current; check the box if it has changed.

- Fill in your Taxpayer Identification Number (TIN) or Social Security Number (SSN) in the provided field.

- Indicate your business activity by selecting the applicable options related to your operations, specifically for Navajo goods and services.

- Record the gross receipts for Navajo goods and services in whole dollars on lines 1 and 2 respectively. Then, compute the total gross receipts by adding these two amounts together, and enter the total on line 3.

- Complete the deductions section by detailing standard deductions, salaries paid to Navajos, and purchases of Navajo goods and services. Make sure to calculate and enter total deductions on line 9.

- Calculate your Navajo source gains by subtracting the total deductions from total gross receipts, and enter this amount on line 10.

- From the Navajo source gains, compute the Business Activity Tax by multiplying this figure by 5%, and record it on line 11.

- If applicable, indicate any tax paid with extension requests in line 12, and then determine the balance of tax due by subtracting this amount from line 11 on line 13.

- If applicable, calculate any interest and penalties owed and enter these amounts in lines 14 and 15 respectively.

- Finally, summarize and record the total taxes due in line 16.

- After completing the form, you can choose to save your changes, download the document, print it, or share it as needed.

Complete your documents online today and ensure your business remains compliant with the Navajo Tax Commission.

of construction projects undertaken on the Navajo Nation and the BAT imposes a 5% tax to business activities occurring on the Navajo Nation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.