Loading

Get Form Gt-9a-b Gasoline Refund Application For Those ... - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

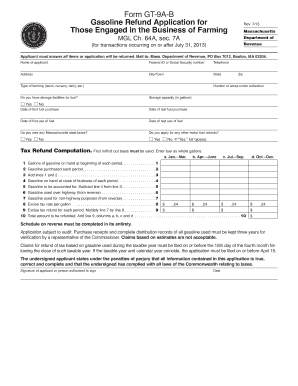

How to fill out the Form GT-9A-B Gasoline Refund Application for those engaged in the business of farming online

This guide provides clear, step-by-step instructions on how to fill out the Form GT-9A-B Gasoline Refund Application, designed for individuals engaged in farming activities. By carefully following these steps, users can ensure a smooth submission process and maximize their chances of a successful refund application.

Follow the steps to complete your gasoline refund application accurately.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Start with the 'Name of applicant' field: Enter the full name of the person applying for the refund. Make sure to provide the correct spelling to avoid rejection of the application.

- Fill in the 'Federal ID or Social Security number': This is crucial for identification purposes. Ensure that you enter it accurately.

- Input your 'Telephone' number. This should be a number where you can be reached easily for any questions related to your application.

- Complete the 'Address' field, including 'City/Town', 'State', and 'Zip': This information is necessary for correspondence and must reflect your current residence.

- Indicate 'Type of farming' you are engaged in (e.g., stock, nursery, dairy, etc.). Choose the most appropriate description to clarify your agricultural activities.

- Answer whether you have 'storage facilities for fuel': Select 'Yes' or 'No' as appropriate and provide further details if you select 'Yes'.

- Fill in the 'Number of acres under cultivation' and 'Storage capacity (in gallons)': This data helps evaluate your farming scale and fuel requirements.

- Provide the 'Date of first fuel purchase' and 'Date of last fuel purchase': Record the relevant purchase dates as accurately as possible.

- Enter the 'Date of first use of fuel' and 'Date of last use of fuel': These dates should differ from purchase dates and reflect actual usage.

- Respond to whether you owe any Massachusetts state taxes and if you apply for any other motor fuel refunds. List types if applicable.

- Complete the Tax Refund Computation section: You will need to enter the gasoline details for each reporting period as specified in the form.

- Calculate the total amount to be refunded by following the provided instructions and enter the necessary computations, ensuring accuracy across all fields.

- Review the statement at the end of the application. The applicant must sign and date the form, affirming that all information is truthful and complete.

- If your application includes gasoline used by custom operators, fill in their information as directed and ensure proper records are maintained.

- Once all sections have been completed and reviewed for accuracy, save your changes, download the completed form, print it for mailing, and ensure to follow up with any necessary distribution records.

Complete your Form GT-9A-B Gasoline Refund Application online today to ensure you receive your refund promptly.

Taxes are the primary way we pay for publicly owned transportation assets and operations, and gas taxes are dedicated to supporting these investments. The state motor fuels excise, or “gas tax,” is 24 cents per gallon, collected by wholesalers, and added to the price at the pump.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.