Loading

Get Form Sft-9-b Special Fuels Refund Application - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form SFT-9-B Special Fuels Refund Application - Mass.Gov - Mass online

This guide provides a comprehensive overview of how to accurately complete the Form SFT-9-B Special Fuels Refund Application. By following these steps, users can ensure that their application is submitted correctly and efficiently.

Follow the steps to fill out the Special Fuels Refund Application.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in the applicant's name, federal ID or social security number, and telephone number. Ensure that all details are accurate and legible.

- Provide the complete mailing address, including city/town, state, and zip code.

- Indicate from whom the special fuels were purchased and provide the dates of the first and last purchases.

- Answer whether you have storage facilities for special fuels and indicate the storage capacity in gallons.

- Select the type of business and provide the non-taxable purpose for which special fuels were used.

- Indicate if you are applying for any other motor fuel refunds and specify if you owe any Massachusetts state taxes, detailing the type(s) if applicable.

- List the number of motor vehicles and pieces of equipment owned or operated, indicating whether they are registered or unregistered.

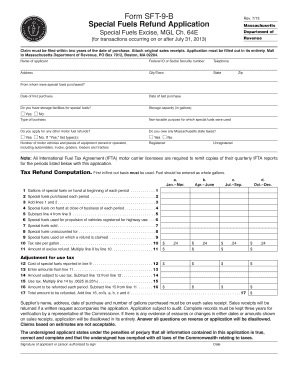

- Complete the tax refund computation section, ensuring to use the first in/first out basis. Enter the relevant data for each quarter as instructed.

- Ensure all calculations are correct, notably the refund amount to be claimed, and check that all questions have been answered.

- Review the application for accuracy and completeness before signing. Note the statement under penalties of perjury.

- Sign and date the application, then attach original sales receipts as required.

- Finalize the process by saving any changes, downloading, printing, or sharing the completed form as needed.

Submit your completed Form SFT-9-B online to ensure a smooth application process.

How much tax do we pay on a gallon of gasoline and on a gallon of diesel fuel? Federal taxes include excises taxes of 18.3 cents per gallon on gasoline and 24.3 cents per gallon on diesel fuel, and a Leaking Underground Storage Tank fee of 0.1 cents per gallon on both fuels.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.