Loading

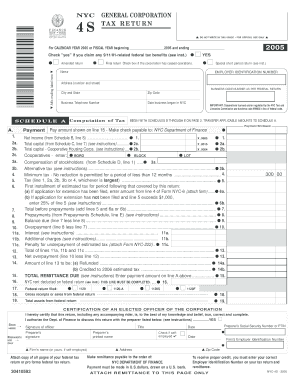

Get Nyc General Corporation Finance 4s Tax Return New York The ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC general corporation finance 4S tax return online

This guide provides clear and supportive instructions for completing the NYC general corporation finance 4S tax return online. By following these steps, users will be able to efficiently fill out the necessary sections of the form.

Follow the steps to accurately complete your tax return.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by providing your corporation's name, employer identification number, and address in the designated fields. Ensure all information is accurate to avoid processing delays.

- Indicate whether this is an amended return or a final return by checking the appropriate box. If your corporation has ceased operations, make sure to check the final return box.

- Fill in the dates corresponding to the calendar year or fiscal year as required. This information helps define the period covered by your return.

- Complete Schedule A, starting with the computation of your tax. Transfer applicable amounts from Schedules B through E as needed, ensuring to follow the provided instructions for calculations.

- Report any claimed benefits related to 9/11/01 in the relevant section, if applicable.

- Continue filling in all financial information, such as net income, total capital, and any compensation of stockholders as needed throughout the various schedules in the form.

- Review the certification section and ensure a designated officer of the corporation signs and dates the form. This affirms the accuracy and completeness of the return.

- Once all sections are completed, save your changes, then proceed to download or print the form for submission.

- If applicable, finalize the payment details, ensuring to remit payment according to the specific guidelines indicated in the instructions.

Take the next step and complete your NYC general corporation finance 4S tax return online today.

Federal S corporations that aren't qualified or don't make a New York S election pay the same corporate franchise taxes as C corporations. Tax credits are applied against the corporation's tax liability and do not flow-through to shareholders.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.