Loading

Get Instructions For Preparation Of Ct-0253 Report On Debt - Comptroller Tn

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the instructions for preparation of CT-0253 report on debt - Comptroller TN online

Filling out the CT-0253 report on debt obligation is an essential process for public entities in Tennessee. This guide provides systematic and clear steps to ensure accurate and efficient completion of the form online.

Follow the steps to complete the CT-0253 report accurately.

- Press the ‘Get Form’ button to access the CT-0253 report and open it for filling out.

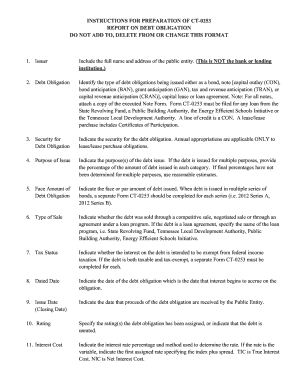

- In the Issuer section, include the full name and address of the public entity, not the bank or lending institution.

- For the Debt Obligation section, specify the type of debt being issued, such as a bond, note, capital lease, or loan agreement. Attach an executed Note Form if applicable.

- In the Security for Debt Obligation field, indicate the type of security backing the debt, specifically for lease/lease purchase obligations.

- State the Purpose of Issue by detailing the reasons for the debt issuance and percentage distribution if multiple purposes are involved.

- Indicate the Face Amount of Debt Obligation, specifying the total amount being issued and completing separate forms for each series.

- In the Type of Sale section, clarify how the debt was sold — via competitive sale, negotiated sale, or loan program specifics.

- Complete the Tax Status field, indicating whether the interest is intended to be exempt from federal income tax.

- Fill in the Dated Date, which is the interest accrual date, and the Issue Date for when the debt obligation proceeds are received.

- Provide the Rating(s) assigned to the debt obligation or indicate if it is unrated.

- Specify the Interest Cost, including the rate percentage and method of calculation, indicating if it is variable.

- List Recurring Costs associated with remarketing, liquidity, and credit enhancement, detailing applicable fees.

- In the Maturity section, indicate the years for principal repayments and the interest rate for each maturity period.

- Complete the Debt Repayment Schedule with cumulative amounts for both the issue and total debt outstanding.

- Provide an Itemized Description of the Cost of Issuance, rounding amounts to the nearest dollar and listing all incurred costs.

- Detail any Continuing Disclosure Obligations, identifying the responsible person and the due date for disclosures.

- Include a description of Compliance with Written Debt Management Policy, submitting the current policy if it hasn’t been filed recently.

- If applicable, describe any Derivative related to the debt obligation with relevant compliance documentation.

- Gather the Signatures of both the Authorized Representative and Preparer of the form, ensuring proper authorities are indicated.

- File the completed Form CT-0253 with the governing body and the Director of the Office of State and Local Finance within the 45-day window.

- After completing the form and necessary attachments, save your changes, download, print, or share the document as needed.

Complete your CT-0253 report today to ensure compliance with Tennessee's reporting requirements!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.