Loading

Get Mo Form 2827

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo Form 2827 online

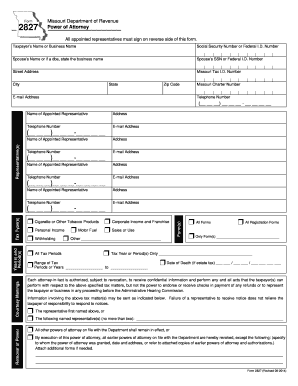

Filling out the Mo Form 2827 online can streamline the process of establishing power of attorney for tax matters in Missouri. This guide provides clear and supportive instructions to ensure that users can complete the form accurately and efficiently.

Follow the steps to complete the Mo Form 2827 with ease.

- Press the ‘Get Form’ button to access the Mo Form 2827 in your preferred digital format.

- Begin by filling in the taxpayer's name or business name in the designated field. Ensure that the information matches official records to avoid processing delays.

- Input the Social Security Number or Federal I.D. Number in the appropriate field, as this is essential for identification purposes.

- If applicable, include the spouse's name or the business name for a 'doing business as' (dba) registration, along with their Social Security Number or Federal I.D. Number.

- Complete the address section with the street address, city, state, and zip code associated with the taxpayer or business.

- Provide an email address and phone number for communication regarding the power of attorney.

- List the appointed representative(s) by filling in their names, addresses, phone numbers, and email addresses in the designated fields. Ensure all representatives sign as required.

- Specify the type of tax matters the power of attorney covers by selecting from the options provided (e.g., personal income, corporate income).

- If there are specific years or periods that the power of attorney applies to, indicate those in the appropriate section.

- Sign and date the form. Make sure the signature matches the printed name and that the signer is authorized to act on behalf of the taxpayer.

- Once all fields are completed and verified, save the document. You can then download, print, or share the completed form as needed.

Start filling out the Mo Form 2827 online today for a smoother power of attorney process.

Penalty Abatement State law allows the DOR to add a 100% penalty for employers who willfully attempt to evade income tax or sales or use tax. Individuals can face penalties of up to 30% of their tax liability. Unfortunately, however, the state does not advertise any penalty abatement programs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.