Loading

Get City Of Aspen Rett Exemption Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of Aspen Rett Exemption Application online

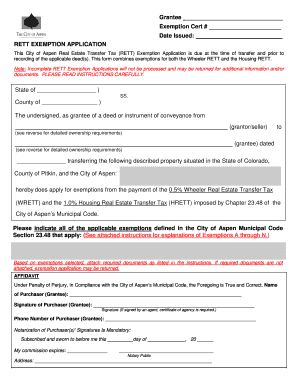

Filling out the City Of Aspen Real Estate Transfer Tax (RETT) Exemption Application online can seem complex, but with the right guidance, the process can be straightforward. This guide provides detailed instructions on each section of the application to ensure that you complete it accurately and efficiently.

Follow the steps to successfully complete your application

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering your name as the grantee in the designated field. This is crucial as it identifies you as the applicant for the exemption.

- Next, input the Exemption Certificate Number and the Date Issued. Ensure that these details are accurate to avoid confusion during processing.

- Provide information about the grantor/seller, including their full name. This section is vital for establishing the transaction's context.

- Describe the property involved in the transaction by including its address and other identifying details such as the lot number.

- Identify all applicable exemptions by selecting from the list provided in the form. Refer to the attached instructions for definitions of each exemption.

- Attach all required documentation that supports your claim for exemption based on the selected categories. This is a key step, as incomplete applications will be returned.

- Fill out the Affidavit section, providing your signature and contact information. If an agent is signing, ensure a certificate of agency is included.

- Ensure notarization of the application by having it signed by a notary public. This step is mandatory for the application to be valid.

- Lastly, review the entire application for accuracy. Once verified, you can save changes, download, print, or share the completed form online.

Complete your City Of Aspen Rett Exemption Application online today for a smoother filing experience.

(WRETT) and the 1.0% Housing Real Estate Transfer Tax (HRETT) imposed by Chapter 23.48 of the City of Aspen's Municipal Code.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.