Loading

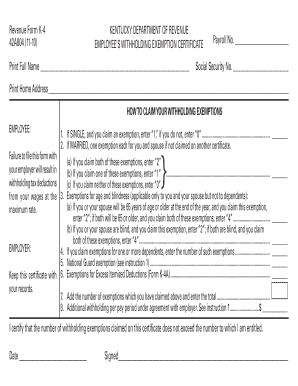

Get How To Claim Your Withholding Exemptions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HOW TO CLAIM YOUR WITHHOLDING EXEMPTIONS online

This guide provides a comprehensive overview of completing the How to Claim Your Withholding Exemptions form online. Whether you are familiar with this process or new to it, our clear instructions aim to assist you in ensuring that your information is accurately submitted.

Follow the steps to complete your withholding exemptions form with ease.

- Click the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering your full name in the designated field, followed by your payroll number and Social Security number.

- Provide your home address in the appropriate area, ensuring all information is accurate and complete.

- For the first exemption section, identify your marital status. If you are single and claiming an exemption, enter ‘1’; if not, enter ‘0’. For those who are married, enter ‘1’ for each spouse if no other certificate claims an exemption.

- Continue to the age and blindness exemptions section. If you or your spouse will be 65 or older, input ‘2’; if both qualify, enter ‘4’. If claiming blindness exemptions, follow the same format based on the number qualifying.

- For dependents, specify the number of exemptions claimed for them in the next section.

- Complete the national guard exemption if applicable, referring to the specific instructions provided.

- If you are claiming exemptions for excess itemized deductions, enter the relevant information in the next field.

- Sum the total number of exemptions claimed and enter this in the final calculations section.

- Lastly, if you have an agreement with your employer for additional withholding per pay period, specify that amount.

- Review all information carefully. Once everything is correct, you can save your changes, download, print, or share the form as needed.

Complete your withholding exemptions form online to ensure accurate tax withholding and maximize your potential refunds.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.