Loading

Get Tr1 - Tax Registration Form For Sole Traders/trusts ... - Quintas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TR1 - Tax Registration Form for Sole Traders/Trusts online

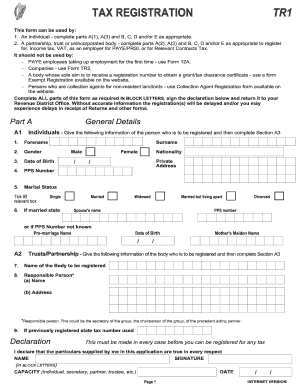

Filling out the TR1 - Tax Registration Form for Sole Traders/Trusts is essential for individuals or bodies seeking tax registration. This guide provides a step-by-step approach to ensure accurate completion of the form online, streamlining your registration process.

Follow the steps to fill out the TR1 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part A, General Details, fill in personal information as follows: For individuals, include your forename, surname, gender, date of birth, marital status, and PPS number. If you are part of a partnership or trust, provide the name of the body, responsible person's details, and any previous tax number if applicable.

- Continue in Part A with information regarding all partners, trustees, or officers. Document their names, private addresses, and capacities. If necessary, provide additional information on a separate sheet.

- In Part A, Business Details, specify if you are trading under a business name, your legal format (sole trade, partnership, or other), and provide the business address if different from your private address. Describe the main business type and the commencement date.

- For Part B, indicate if you are registering for income tax by ticking the appropriate box and detailing your main source of income.

- In Part C, for VAT registration, check the required box and specify the date from which registration is needed. Select whether your registration is due to turnover exceeding the prescribed limits, electing to be a taxable person, or related to services.

- Part D focuses on registration as an employer for PAYE/PRSI. Tick the box if applicable and provide details about your employees and payroll system.

- In Part E, if registering as a Principal Contractor for Relevant Contracts Tax, fill out the necessary information regarding subcontractors. Confirm that required forms have been completed.

- Once all sections are completed accurately, review your form, sign the declaration, and submit it to the appropriate Revenue District Office. Ensure that all fields have been filled out in block letters.

Complete your TR1 registration form online to ensure a smooth tax registration process.

A Tax Registration Number (TRN) is issued by Revenue when you register for tax as a sole trader, trust, partnership or company. You must use your TRN when trading and filing your tax returns as a sole trader, trust, partnership or company.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.