Loading

Get Case Information Statement (cis-lp)tax Court Of New Jersey ... - Judiciary State Nj

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Case Information Statement (CIS-LP) Tax Court Of New Jersey online

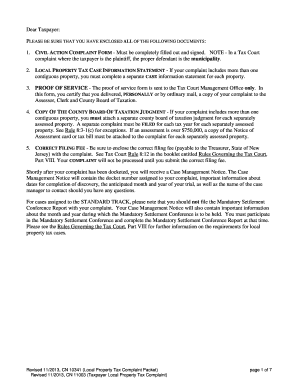

Filling out the Case Information Statement (CIS-LP) is a crucial step in submitting a property tax appeal in New Jersey. This guide will offer you detailed instructions on how to complete the form correctly, ensuring that you meet all necessary requirements for your appeal.

Follow the steps to fill out the Case Information Statement accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the necessary document to proceed with your case.

- Begin by filling out your personal information or attorney information at the top of the form. Make sure to provide your name, contact information, and attorney ID number if applicable.

- In Part A, check the appropriate case type that corresponds to your situation, such as 'Direct Appeal' or 'Added or Omitted Assessment.' You will also need to indicate whether the case is related to Hurricane Sandy and enter the correct filing fee.

- Complete Part B by providing details about the parties involved, including the Plaintiff and Defendant, the property information such as County, Block, Lot, and Unit, as well as the Assessment Year(s) in contest.

- In Part C, fill in the assessment values for both land and improvements. Ensure that you detail any exemptions accurately.

- If your case pertains to farmland rollback, complete Part D with the relevant values, including non-qualified and qualified assessed values.

- For added assessments, use Part E to provide necessary financial details pertaining to the added assessment and any prorated assessments.

- Indicate if you or your client have any needs under the Americans with Disabilities Act and whether an interpreter is needed. This ensures all parties receive necessary accommodations.

- Finally, certify that confidential personal identifiers have been redacted from the documents and sign the form. You will also need to prepare a Proof of Service to show that all parties, including the Clerk and Assessor, have received the complaint.

- Once you have completed all sections accurately, you can save changes, download the form, print it, or share it as required.

Complete your Case Information Statement online to ensure a smooth filing process for your property tax appeal.

Related links form

The Tax Court is a court of limited jurisdiction. Tax Court Judges hear appeals of tax decisions made by County Boards of Taxation. They also hear appeals on decisions made by the Director of the Division of Taxation on such matters as state income, sales and business taxes, and homestead rebates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.