Loading

Get Retired Income Tax Form - Formrouter.net - Formrouter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the retired income tax form - Formrouter.net - Formrouter online

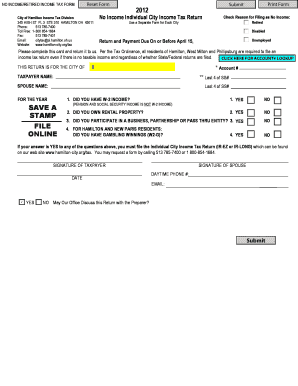

Completing the retired income tax form is essential for maintaining compliance with local tax regulations. This guide provides clear instructions on how to effectively fill out each section of the form online, ensuring a smooth filing process.

Follow the steps to successfully complete your tax form.

- Click the ‘Get Form’ button to access the retired income tax form and open it in the editor.

- Select the tax year for which you are filing, using the dropdown provided at the top of the form. Make sure it reflects the correct year.

- Provide your personal details in the taxpayer name section, ensuring it follows the prescribed format: last name, first name (e.g., Doe, John).

- If applicable, complete the spouse name section in the same format as above, using the last four digits of their social security number.

- Indicate your reason for filing as 'No Income' by checking the box for 'Retired' and any other relevant reasons listed.

- Answer the questions regarding W-2 income, rental property, business participation, and gambling winnings as they apply to you. Select 'Yes' or 'No' to each question.

- Enter your daytime phone number, email address, and tax preparer email if applicable in the designated fields.

- Review all entered information for accuracy. When satisfied, choose to save your changes, download the form, or print it for your records.

- Finally, if necessary, submit the form electronically by confirming your account number and following any additional prompts.

Complete your tax form online today for a hassle-free filing experience.

Anyone who receives a 1099-R must include the amount shown on it in their income tax return and pay applicable taxes. If you receive a 1099-R, keep in mind that not all distributions from retirement or tax-deferred accounts are subject to tax.1 A direct rollover from a 401(k) plan to an IRA is one example.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.