Loading

Get Mod. 22-rfi - Steuerliches-info-center

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the MOD. 22-RFI - Steuerliches-info-center online

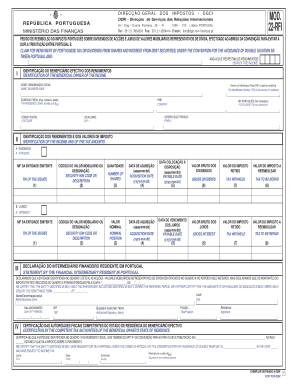

The MOD. 22-RFI form is essential for claiming repayment of Portuguese tax on dividends and interest from debt securities. This guide will provide you with step-by-step instructions on how to complete the form accurately and efficiently, ensuring that your filing is successful.

Follow the steps to fill out the MOD. 22-RFI form correctly.

- Click ‘Get Form’ button to obtain the MOD. 22-RFI form and open it in your editor.

- Complete Box I, identifying the beneficial owner. Ensure the name or business name and address are fully detailed, using capital letters when writing by hand.

- Enter the tax identification number (TIN) from the country of residence in Box I. If applicable, include the Portuguese TIN that was previously required for tax withholding.

- In Box II, mark the nature of the income being claimed for repayment by placing an 'X' in the appropriate area. Fill out all columns, including the mandatory ISIN code or the description of the security if there is no ISIN available.

- Provide amounts in euros based on the exchange rate used for withholding tax calculations in Box II.

- If further lines are needed, make copies of the form and continue filling out the required information.

- Box III must be filled out by the financial intermediary in Portugal or their legal representative. Ensure it is signed and certified to confirm the entity's role and the tax amounts withheld.

- Box IV should be completed by the competent tax authorities of the beneficial owner's state of residence, certifying the information provided.

- In Box V, answer the questions with 'yes' or 'no' and provide additional details where necessary.

- Use Box VI if the beneficial owner holds shares or debt securities through a non-resident financial intermediary in Portugal.

- Complete Box VII to identify the entity required to withhold tax, making sure to fill in all information clearly.

- Box VIII is for identifying the beneficial owner's legal representative in Portugal, required only if they intend for this representative to handle the claim.

- Finally, sign Box IX to confirm the accuracy of the information provided and submit the completed form to the appropriate authorities.

Start filling out the MOD. 22-RFI form online today to ensure your tax claims are processed efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.