Loading

Get Request Tax Refund Form For Taiwan Workers.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request Tax Refund Form For Taiwan Workers.doc online

This guide provides you with clear and comprehensive instructions on how to fill out the Request Tax Refund Form for Taiwan Workers online. Follow the steps outlined below to ensure your form is completed accurately and submitted successfully.

Follow the steps to fill out the form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the date at the top of the form. This is essential for processing your request.

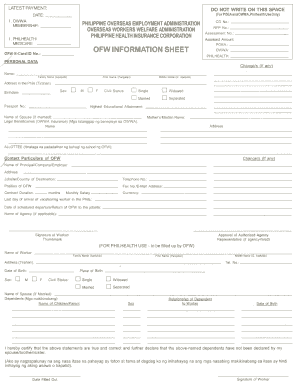

- In the section labeled '1.0WWA MEMBERSHIP', indicate whether you are registered with the Philippine Overseas Employment Administration, Overseas Workers Welfare Administration, or Philippine Health Insurance Corporation by checking the relevant box.

- Record your PhilHealth membership number in the space provided next to 'PhilHealth Medicare'.

- Provide your assessment number and assessed amounts for POEA, OWWA, and PhilHealth as needed.

- Select your marital status by checking the corresponding box: Single, Married, Widowed, or Separated.

- If married, fill in the name of your spouse in the designated space.

- List your legal beneficiaries for OWWA insurance by writing their names and contact particulars.

- Enter details about your employment: name of the principal company or employer, address, job site or country of destination, position, contract duration in months, and monthly salary.

- Fill in your telephone number, fax number, and email address for contact purposes.

- Document the last day of your arrival as a vacationing worker in the Philippines along with the date scheduled for your departure or return to the job site.

- If applicable, provide the name of the agency that facilitated your employment.

- Ensure you sign the form or include your thumb mark in the designated area.

- If you are agency-hired, have an authorized agency representative approve your application.

- Lastly, review all entries for accuracy, then save your changes, and opt to download, print, or share the form as needed.

Complete your documents online to ensure a smooth tax refund process.

Before your luggage check-in, please take your passport and Tax Refund Claim Form to the E-VAT Refund machine or Tax Refund Service Counter, to prove your foreign identity and check the Tax refundable receipts. The Tax refund system will instruct you if the goods need to be examined by the Customs or not.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.