Loading

Get Ar1000v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar1000v online

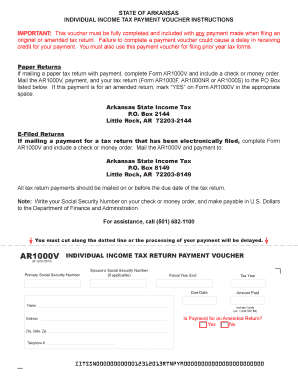

Completing the Ar1000v online is a crucial step for ensuring your tax payments are processed correctly. This guide provides clear, step-by-step instructions to help you successfully fill out the form and avoid delays in receiving credit for your payment.

Follow the steps to fill out the Ar1000v effectively.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Begin by entering your primary Social Security number in the designated field. If applicable, provide your spouse’s Social Security number in the following field.

- Indicate the fiscal year end. This should reflect the year for which you are making the payment.

- Enter the due date for your payment. Ensure that this date aligns with your tax return deadlines.

- Fill in your name and complete your address details, including city, state, and zip code.

- Provide your telephone number for any potential follow-ups or inquiries.

- Specify the tax year relevant to your payment. This is essential for proper processing.

- Clearly indicate the amount you are paying, including cents (for example, enter '1,234,567.89').

- Lastly, check the box to indicate whether your payment is for an amended return. Choose 'Yes' or 'No' as applicable.

- Once you have filled out all fields, review your information for accuracy. You can then save changes, download, print, or share the completed form as needed.

Start filling out your Ar1000v online today to ensure your tax payments are processed smoothly.

2021 Low Income Tax Tables To qualify for the Low Income Tax Table, you must earn less than $32,200 and if you're married, you must file a joint tax return. If you itemized your tax deductions, you must use the Regular Income Tax Table.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.