Loading

Get Form-5 - Esic - Esichennai

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form-5 - ESIC - Esichennai online

This guide provides clear and detailed instructions on how to complete the Form-5 - ESIC - Esichennai online. Following these steps will help ensure accurate submission and compliance with regulations.

Follow the steps to successfully complete the Form-5 - ESIC - Esichennai.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

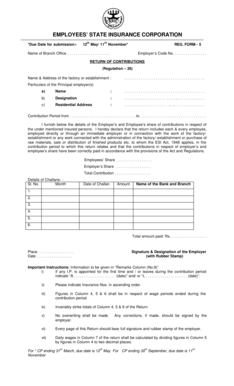

- Begin by filling in the name of the branch office and the employer's code number in the designated fields. Ensure these details are accurate.

- Provide the name and address of the factory or establishment where the contributions are applicable.

- Enter particulars of the principal employer(s) including their name, designation, and residential address.

- Indicate the contribution period by entering the start and end dates clearly.

- Detail the employer’s and employee’s share of contributions for the insured persons as per the contribution period. Ensure every employee is accounted for in this section.

- In the 'Details of Challans' section, fill the serial number, month, date of challan, amount, and name of the bank and branch accurately for each entry.

- Provide a total amount paid at the end of the details of challans.

- Fill in the place and date where you are submitting the return.

- Include the signature and designation of the employer along with the rubber stamp of the employer.

- Review the form for any necessary remarks in Column 9, especially related to the appointment or leaving of employees during the contribution period.

- Final checks should include ensuring totals are struck out correctly for columns 4, 5, and 6, and no overwriting is done.

- Once completed, save your changes and consider downloading or printing the form for your records.

Start filling out your Form-5 - ESIC - Esichennai online today to ensure timely compliance.

The ESI returns are filed half-yearly and can be done through their online portal. To file, ESI returns online, you need to: Collect the user id and password from the ESIC office. The login credentials are essential for filing returns through the portal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.