Loading

Get Qbe Insuracne Holdings Pty Limted - W 8 Ben E Form.pdf - Qbe.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the QBE Insurance Holdings Pty Limited - W-8 BEN E Form online

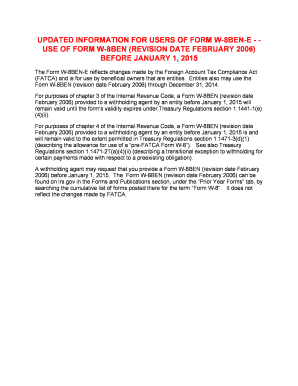

Filling out the QBE Insurance Holdings Pty Limited - W-8 BEN E Form is a crucial step for entities seeking to certify their status for U.S. tax withholding and reporting. This guide will provide you with a clear, step-by-step approach to completing the form accurately and efficiently online.

Follow the steps to successfully complete the W-8 BEN E Form.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Begin by filling out Part I, which includes your entity name, country of incorporation, and chapter statuses. Ensure that you check only one box for both Chapter 3 Status and Chapter 4 Status.

- Provide your permanent residence address in the designated fields and ensure it does not include a P.O. Box or in-care-of address.

- If applicable, fill out Part II regarding the disregarded entity or branch receiving payment, including its address and relevant GIIN.

- Proceed to Part III if you are claiming tax treaty benefits, and ensure to check the appropriate boxes while providing a brief explanation of how you meet the treaty requirements.

- Complete any additional parts that apply to your specific entity type, such as Parts IV through XXVII, based on your FATCA classification.

- In Part XXIX, certified by an authorized individual, sign and date the form to confirm that all information is accurate and complete.

- Finally, save your changes, and choose to download, print, or share the completed form according to your needs.

Complete your documents online today for smooth processing!

Who Can File W-8 Forms? W-8 forms are filled out by foreign individuals or entities that lack U.S. citizenship or residency, but have worked in the U.S. or earned income in the U.S. This usually applies to foreign-domiciled businesses and non-resident aliens.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.