Loading

Get Form Nj 1040nr V

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Nj 1040nr V online

Filling out the Form Nj 1040nr V online can be a straightforward process when you have clear guidance. This guide will provide you with step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete your Form Nj 1040nr V.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

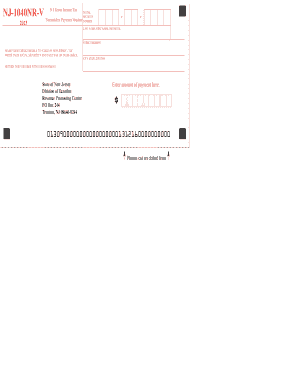

- Enter your social security number in the designated field at the top of the form, formatted as XXX-XX-XXXX.

- Fill in your last name, first name, and initial in the specified fields, ensuring names are accurate to avoid processing delays.

- Complete your street address, including the city, state, and zip code, in the appropriate sections to ensure proper identification.

- In the payment section, enter the amount you are submitting in the designated field, ensuring accuracy to prevent issues with your payment.

- Prepare your check made payable to ‘State of New Jersey - TGI’, writing your social security number and tax year on the check for reference.

- Review all information entered in the form for accuracy. Make necessary corrections to ensure all details are correct.

- Once satisfied, save your changes, and you may choose to download or print the form for your records.

- Return the voucher with your payment to the address provided on the form: State of New Jersey, Division of Taxation, Revenue Processing Center, PO Box 244, Trenton, NJ 08646-0244.

Complete your documents online now for a seamless filing experience.

00. TGI-EE - Gross Income Tax - Emp.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.