Loading

Get Request An Ira Distribution - Charles Schwab

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request An IRA Distribution - Charles Schwab online

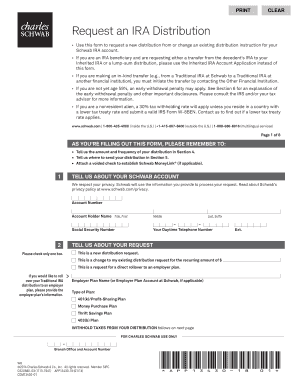

Filling out the Request An IRA Distribution form with Charles Schwab is an essential step for users looking to manage their retirement funds efficiently. This guide will provide clear and supportive instructions to help you navigate the form online, ensuring you complete it accurately.

Follow the steps to successfully complete the Request An IRA Distribution form.

- Click ‘Get Form’ button to access the Request An IRA Distribution document and open it for editing.

- In Section 1, enter your Schwab account number, account holder name, and social security number. Ensure that all information is accurate and up to date.

- In Section 2, specify whether this is a new distribution request, a change to an existing distribution request, or a request for a direct rollover. Check the appropriate box to indicate your selection.

- Proceed to Section 3, where you can decide on federal income tax withholding options. Choose whether you want federal income tax withheld or not, and specify a percentage if applicable.

- In Section 4, provide details about the distribution amount and its frequency. Indicate whether it is a one-time distribution or recurring, and fill out the corresponding fields.

- In Section 5, state where you would like the distribution sent, selecting whether to transfer it to a Schwab brokerage account, mail a check, wire funds, or set up an electronic transfer. Ensure you provide any necessary bank details based on your choice.

- Review the important information in Section 6 regarding tax implications and distribution rules. Make sure you understand these before finalizing your request.

- In the final section, provide your signature and date to authorize the request. Make sure to return all pages of the completed form to Schwab as instructed.

Start completing your Request An IRA Distribution form online today to manage your retirement funds effectively.

Frequently Asked Questions Generally, the limitation on withdrawing funds from an IRA is one withdrawal per year. In addition, taxes and penalties may be associated with taking money out before age 59 1/2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.