Loading

Get Change In Ownership Statement (death Of Real Property Owner)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Change In Ownership Statement (Death Of Real Property Owner) online

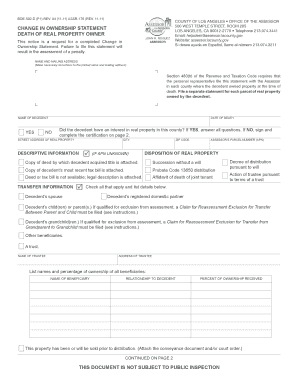

The Change In Ownership Statement is an essential document for reporting the transfer of property ownership due to the death of a real property owner. This guide will walk you through the process of completing this form online, ensuring you understand each section and providing support along the way.

Follow the steps to successfully complete the Change In Ownership Statement online.

- Click the ‘Get Form’ button to access the Change In Ownership Statement and open it in the online editor.

- Begin by reviewing the pre-filled name and mailing address. Make any necessary corrections to ensure the information is accurate.

- In the first section, provide the name of the decedent, confirming whether they had an interest in real property in the county at the time of their death. Select 'Yes' if applicable and proceed to answer all subsequent questions.

- Record the date of death of the decedent in the designated field.

- Next, enter the street address of the real property owned by the decedent, including the city and zip code. If the Assessor’s Parcel Number (APN) is unknown, check the designated box.

- In the 'Disposition of Real Property' section, check all applicable options regarding how the decedent acquired the property and attach any relevant documents that support your selections.

- Proceed to the 'Transfer Information' section where you will list the names of beneficiaries and their percentage of ownership received from the decedent. Include details of any spouses, domestic partners, or children.

- Answer the questions regarding legal entities and leases if applicable, providing necessary details as indicated.

- In the final section labeled 'Mailing Address for Future Property Tax Statements', enter the address where future tax statements should be sent.

- Complete the certification section by signing, printing your name, and adding your contact details. Ensure all provided information is accurate and true to the best of your knowledge.

- After thoroughly reviewing the completed form for any errors, you may save your changes, download a copy for your records, print it, or share it as needed.

Complete and file your Change In Ownership Statement online to ensure compliance and avoid penalties.

The Change in Ownership Statement Death of Real Property Owner Form (BOE-502-D/ ASSR-176) is required to be completed and submitted to the Assessor's Office, even if the decedent held the property in a trust.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.