Loading

Get Tc 547

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 547 online

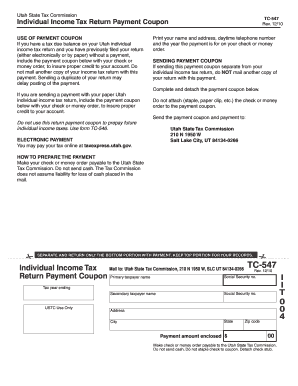

The Tc 547 form serves as a payment coupon for individuals who need to remit their Utah state income tax payment. This guide will provide step-by-step instructions on how to correctly fill out the form online, helping to ensure that your payment is properly credited to your account.

Follow the steps to complete your Tc 547 payment coupon

- Click the ‘Get Form’ button to access the Tc 547 form and open it in the editor.

- Begin by entering your primary taxpayer name in the designated field. This should be the person responsible for the tax payment.

- Fill in the primary taxpayer's Social Security number (SSN) accurately to ensure proper identification of your account.

- Specify the tax year for which you are making the payment. This is crucial for the Tax Commission to apply your payment correctly.

- Enter the address of the primary taxpayer, including the street, city, state, and zip code. Make sure this information is current and accurate.

- If applicable, provide the secondary taxpayer's name and SSN. This section is for joint filers or if there is a partner in the responsibility for the payment.

- Indicate the total payment amount you are enclosing. Ensure this matches the amount owed for the specified tax year.

- Note that your check or money order should be made payable to the Utah State Tax Commission. Avoid sending cash, as it will not be accepted.

- Detach the payment coupon portion from the form carefully and do not staple or paper clip your payment to it.

- Once completed, mail the payment coupon and your payment to the address specified: Utah State Tax Commission, 210 N 1950 W, Salt Lake City, UT 84134-0266.

Complete your Tc 547 payment coupon online and ensure your tax payment is submitted accurately and efficiently.

“Pass-through entity” or “PTE” means a business entity that is an S-Corporation, an estate or trust, or classified as a partnership for federal income tax purposes. “SALT Report” means the TC-75 report that an electing PTE is required to electronically file with Utah.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.