Loading

Get Beneficiary Designation - Usw Benefit Funds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Beneficiary Designation - USW Benefit Funds online

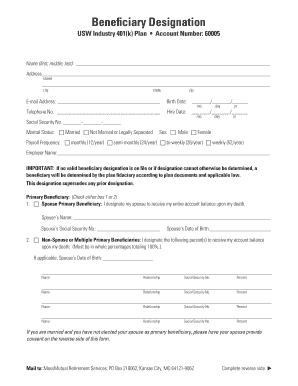

Filling out the Beneficiary Designation form for the USW Industry 401(k) Plan is an important process to ensure that your benefits are allocated according to your wishes. This guide provides a clear and supportive walkthrough of each section of the form to assist you in completing it accurately and efficiently.

Follow the steps to complete your form correctly.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Fill in your personal information. This includes your full name, address (street, city, state, zip code), email address, birth date, telephone number, hire date, and social security number.

- Indicate your marital status by checking the appropriate box for married or not married/legal separation.

- Select your sex by checking the respective box for male or female.

- Choose your payroll frequency by checking one of the options: monthly, semi-monthly, bi-weekly, or weekly.

- Enter your employer's name as requested.

- Designate your primary beneficiary by checking either the spouse primary beneficiary box or the non-spouse/multiple primary beneficiaries box. Ensure the designation is accurate as this supersedes any prior designations.

- If designating a spouse as your primary beneficiary, provide their name, social security number, and date of birth.

- If designating non-spouse beneficiaries, list each individual's name, relationship to you, social security number, and percentage of the account balance they should receive. The total must equal 100%.

- If you are married and do not choose your spouse as the primary beneficiary, ensure your spouse provides consent by signing on the reverse side of the form.

- If applicable, designate secondary beneficiaries with the same information required as the primary beneficiaries.

- Sign and date the form to confirm that this designation overrides any previous ones. Ensure all information is correct before submission.

- Finally, mail the completed form to MassMutual Retirement Services at the provided address.

Complete your Beneficiary Designation form online today to secure your benefits and ensure your wishes are honored.

If you take a lump sum distribution, you may incur hefty taxes, if you realize a significant income or the money may push you into a higher tax bracket. If the inherited 401(k) is pre-tax, you'll pay taxes at ordinary income rates. If the account is a Roth 401(k), then you won't owe any income taxes on the withdrawal.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.