Loading

Get Planwithease Salary Reduction Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Planwithease Salary Reduction Form online

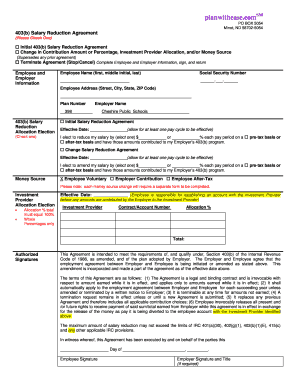

Completing the Planwithease Salary Reduction Form online is a simple process that allows users to manage their salary contributions to a 403(b) plan effectively. This guide provides you with detailed instructions to ensure that you fill out the form correctly and efficiently.

Follow the steps to fill out the form seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the employee information section. Enter your full name, including your first, middle initial, and last name. Next, provide your social security number to ensure proper identification.

- In the address field, input your complete address, including street, city, state, and ZIP code. Make sure all information is accurate for effective communication.

- Indicate the plan number assigned to your employer. For this specific form, it is pre-filled as 398.

- Select the appropriate option for the Salary Reduction Allocation Election. Decide whether you are establishing an initial salary reduction agreement, changing the contribution amount or percentage, or terminating the agreement.

- For an initial or change agreement, state the effective date. This date must allow for at least one pay cycle to take effect. Specify either the dollar amount or percentage you wish to reduce from your salary, and indicate whether this will be on an after-tax or pre-tax basis.

- If applicable, check the relevant box regarding money sources, specifying between employee voluntary contributions, employer contributions, after-tax, or pre-tax amounts.

- In the investment provider allocation section, ensure that the total of your allocation percentages equals 100%. Use whole percentages only.

- State the effective date for the investment provider allocation and remember that you need to establish an account with the investment provider before contributions are made.

- Before finalizing, review all provided details for accuracy. Once confirmed, ensure that both the employee and employer (if required) sign the agreement at the bottom, which confirms acceptance.

- Finally, save the changes, and choose to download, print, or share the completed form as necessary.

Start filling out your Planwithease Salary Reduction Form online today!

A 403(b)(7) custodial account provides a tax- deferred opportunity for employees of educational, nonprofit and other 501(c)(3) organizations to save and invest for retirement. It also allows optional contributions by your employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.