Loading

Get 401(k) Operations

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 401(k) Operations online

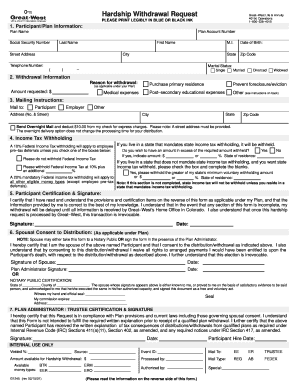

Filling out the 401(k) Operations form online is an essential step for anyone seeking to make a hardship withdrawal from their retirement account. This guide provides straightforward instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to effectively complete your 401(k) Operations withdrawal request.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing your participant and plan information in Section 1. Fill in the plan name, plan account number, social security number, last name, first name, street address, city, state, zip code, date of birth, and telephone number. Ensure all entries are legible and accurate.

- Indicate your marital status by checking the appropriate box: Single, Married, Divorced, or Widowed.

- In Section 2, detail your withdrawal information. Select the appropriate reason for your withdrawal from the provided options and specify the amount you are requesting.

- In Section 3, provide the mailing instructions by indicating whether the funds should be sent to you, your employer, or another address. Be sure to include the full mailing address, including state and zip code.

- In Section 4, specify any income tax withholding preferences. Choose if additional federal income tax should be withheld and enter your state of residence. Make sure to read the instructions on mandatory withholding carefully.

- In Section 5, review and certify your information by signing and dating the form. Ensure that you acknowledge understanding the terms of the withdrawal.

- If applicable, complete Section 6 for spousal consent. The spouse must sign the form in the presence of a plan administrator or notary public, also indicating the date.

- In Section 7, the plan administrator or trustee must sign and date the form, certifying compliance with plan provisions and laws.

- Once all sections are filled out and reviewed, you can save changes, download, print, or share the completed form as needed.

Complete your 401(k) Operations form online today to initiate your hardship withdrawal.

To complete the paperwork that gives you access to your 401(k) funds, you will likely work with your plan administrator, the investment firm that manages the 401(k) and the bank or brokerage firm that holds your new account, if you plan to reinvest it. This process can take a couple of days to a few weeks.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.