Loading

Get Form 1 Financial Hardship

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1 Financial Hardship online

This guide offers comprehensive instructions on how to complete the Form 1 Financial Hardship online, aimed at users seeking financial relief from federally locked-in plans. By following these steps, you can ensure that your application is filled out accurately and efficiently.

Follow the steps to complete the Form 1 Financial Hardship online

- Press the ‘Get Form’ button to access the Form 1 Financial Hardship and open it for editing.

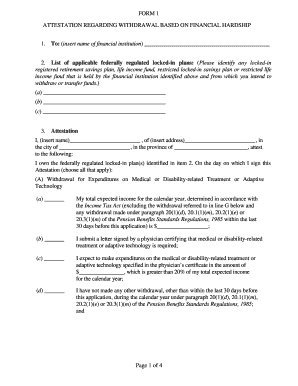

- In the first section, input the name of your financial institution where the locked-in plans are held. Make sure to provide accurate details.

- Next, list any federally regulated locked-in plans, including registered retirement savings plans and life income funds. Provide details in each sub-section (a), (b), and (c) as required.

- For the attestation section, fill in your name and address precisely. Choose the appropriate options regarding your financial circumstances by marking the boxes corresponding to medical expenditures or low income.

- Complete the calculations for expected income and any previous withdrawals. Ensure that you provide figures requested for both the low income and medical components if applicable.

- Calculate the total amount eligible for financial hardship withdrawal based on the provided formulas. Pay attention to ensure accuracy in your entries.

- In the signature section, validate the document by signing and dating it, along with obtaining the necessary notarization if required.

- Finally, save your changes. You may download, print, or share the completed form as needed.

Complete your Form 1 Financial Hardship application online today for quick and efficient processing.

You can unlock up to 50% of your LIRA when you start a Life Income Fund (LIF) and begin regular annual withdrawals. A LIF for a LIRA is like a RRIF (Registered Retirement Income Fund) for an RRSP. Typically, you open one in retirement or by age 71 at the latest and begin government-mandated annual minimum withdrawals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.