Loading

Get 44 Private Car Line Company Report - Nebraska Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 44 Private Car Line Company Report - Nebraska Department Of ... online

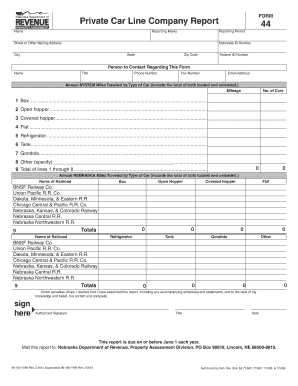

This guide provides comprehensive instructions for completing the 44 Private Car Line Company Report for the Nebraska Department of Revenue. It is designed to help users navigate the form accurately and efficiently.

Follow the steps to successfully complete your report online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the reporting period, including the name of your company, reporting marks, Nebraska ID number, and federal ID number. Ensure that these details are accurate and up-to-date.

- Provide the street or other mailing address, city, state, and zip code. This should reflect your current business location.

- Identify the person to contact regarding this form by providing their name, title, phone number, fax number, and email address. Do ensure this contact information is correct.

- Enter the annual system miles traveled by type of car for loaded and unloaded mileage. Carefully fill out the mileage and number of cars for each classification listed from box to other, summing up the totals.

- Complete the section for annual Nebraska miles traveled by listing the belonging railroads and corresponding mileage for each type of car. Fill in totals accurately.

- Sign the form in the authorized signature field, along with the title and date. Make sure that the declaration is true and correct to the best of your knowledge.

- Once you have completed the report, review for accuracy and completeness before proceeding to save changes. You can download, print, or share the form as needed.

Complete your 44 Private Car Line Company Report online today.

A Form 6 is the Nebraska Sales Tax and Use Form. If you purchase something from a Licensed Nebraska Dealer they are required by the State to provide you with this form so that you can register your vehicle in whatever county you reside.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.