Loading

Get Form 8832, Entity Classification Election - Brrinc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8832, Entity Classification Election - Brrinc online

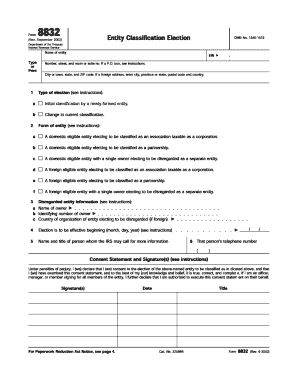

The Form 8832, Entity Classification Election, is an important document for businesses that choose to elect their tax classification. This guide provides step-by-step instructions to assist users in completing the form online with clarity and ease.

Follow the steps to complete your Form 8832 online.

- Click the 'Get Form' button to obtain the form and open it for editing.

- Begin by filling out the identifying information section, including the name of the entity, its address, and employer identification number, if applicable. Ensure this information is accurate as it will be used to correspond with the IRS.

- Choose the entity classification you wish to elect by selecting the corresponding box. Options may include disregarded entity, partnership, or corporation. Review the definitions carefully to ensure correct classification.

- Provide the effective date for your election. This date is essential and should be the date on which you wish the entity classification to take effect.

- Complete any additional information requested in this section, including any other relevant federal tax classification details if applicable.

- Review your entries for accuracy. Use the form's instructions if you have any questions about specific fields.

- After filling out the form, you may save changes, download for your records, print a copy for submission, or share with relevant parties.

Complete your document filing online today.

If the entity is not required to file a return for that year, a copy of its Form 8832 must be attached to the federal tax returns of all direct or indirect owners of the entity for the tax year of the owner that includes the date on which the election took effect.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.