Loading

Get Irs Non Filing Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Non Filing Form online

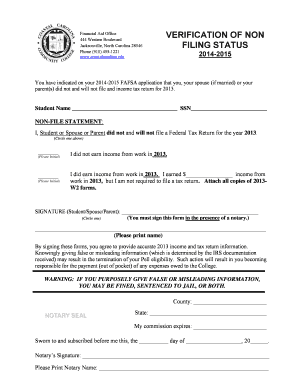

Completing the IRS Non Filing Form is a crucial step for individuals who need to provide verification of non-filing status for a particular tax year. This guide will walk you through the process of filling out the form online with clear and supportive instructions.

Follow the steps to successfully complete the IRS Non Filing Form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the student name and social security number in the designated fields at the top of the form.

- Find the non-file statement section. Indicate whether the student, spouse, or parent did not file an income tax return for the indicated year by circling the appropriate option.

- Initial the statement to confirm that you did not and will not file a Federal Tax Return for the year specified.

- Indicate your income status for the year by checking the appropriate option regarding earned income and provide the total amount if applicable. If you earned income but are not required to file a return, ensure to attach the required copies of the W-2 forms for the year.

- Review the signature section and sign the form in front of a notary. It is essential that the signature is authentic and done in the presence of a notary public.

- Print your name below the signature line as required.

- Provide the county and state details, and the notary's seal and signature area must be filled out accurately.

- Check all sections for completeness and accuracy before finalizing.

- Once completed, save changes, download, print, or share the form as needed.

Complete your IRS Non Filing Form online today to ensure your verification process is seamless.

Online Request: www.irs.gov. ... Telephone Request: (800) 908-9946. ... Paper Request Form: IRS Form 4506-T. ... Individuals Who Are Unable to Obtain an IRS Verification of Non-Filing Letter. ... Individuals Who Are Subject to a Foreign Tax Authority (e.g. Foreign Citizens)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.