Loading

Get Wc 3 Under Assam Value Added Tax Act 2003 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wc 3 Under Assam Value Added Tax Act 2003 Form online

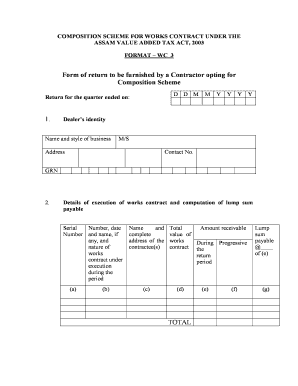

Filling out the Wc 3 form under the Assam Value Added Tax Act 2003 is essential for contractors who opt for the composition scheme. This guide provides step-by-step instructions to help users complete the form accurately online.

Follow the steps to fill out the Wc 3 form seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Next, provide your dealer's identity, including the name and style of your business, address, contact number, and GRN.

- List the name and complete address of each contractee and indicate the total receivable amount and progressive value of the contract.

- Calculate the total lump sum payable based on the amount receivable and enter this value in the designated field.

- Aggregate the total tax deducted in this section.

- Continue by listing your tax deposit details, including the designated bank's name, the type of instrument used, date, and amount.

- Report any excess payment carried forward from the previous return and calculate the total tax to be deposited.

- Enter the value of goods purchased in the state from VAT dealers, in the course of inter-state trade, and any goods imported into the state. Ensure lists are enclosed as required.

- Account for forms received and used during the return period. Specify the number of forms, and the aggregate of transactions for which forms were utilized.

- Once all sections are filled out, save changes to your form. You can download, print, or share the completed form as necessary.

Complete and submit your Wc 3 form online for a seamless filing experience.

VAT is a system whereby a taxable commodity is taxed at every point of sale within the state from the stage of production or manufacture within the state, or from the stage of first sale within the state after import from outside the state, to the stage of sale to the consumer, subject to a threshold limit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.